With the wildfire season rapidly approaching, California’s policymakers and businesses are racing to make homeowner’s insurance accessible once again. The stakes are high, as the outcome could have ripple effects across the economy, particularly as weather disasters become more frequent and severe. California has introduced new regulations aimed at enabling property owners to secure insurance while ensuring insurers remain solvent. However, these changes, which relax restrictions on how insurers set rates, may not suffice.

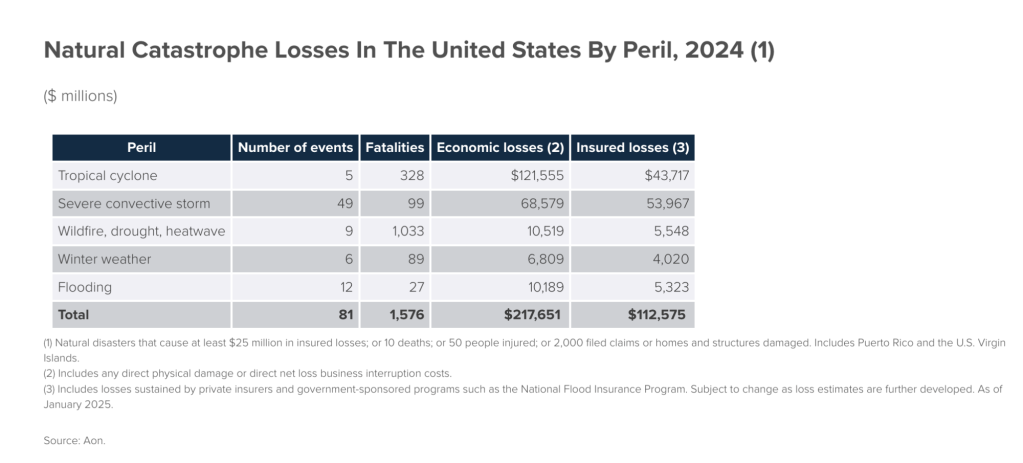

In recent years, climate-related disasters have cost major insurers hundreds of billions of dollars nationwide. This has made it clear that both the industry and regulators need to innovate dramatically if insurers are to remain in business and property owners are to find coverage. A collapse in the property insurance market would impact not only homeowners but also banks, mortgage lenders, developers, and others with exposure to the housing market. Mortgages would become harder to obtain if homes cannot be insured, threatening the broader economy reliant on a robust housing market.

New Regulations and Their Impact

California’s new regulations allow insurers to pass along their reinsurance costs and use future catastrophe models, instead of just past losses, to calculate premiums. In exchange, insurers are required to increase their underwriting in high-risk areas incrementally. Seren Taylor, vice president of the Personal Insurance Federation of California, expressed optimism, stating that these changes could stabilize the market and restore confidence as insurers can more accurately price risk.

However, the state’s Department of Insurance did not respond to requests for comment on the current market conditions and legislative proposals. Former regulations, like Proposition 103, kept premiums artificially low by requiring state approval and public hearings for rate hikes above 7 percent. New legislative proposals aim to require insurers to consider wildfire mitigation in non-renewal decisions and create a legal pathway for insurers to sue fossil fuel companies for losses from extreme weather disasters.

Nationwide Implications

This issue extends beyond California. The U.S. has spent nearly $1 trillion on disaster recovery and climate-related expenses in the year ending May 1, according to Bloomberg Intelligence. This figure amounts to 3 percent of the GDP. Following substantial insured losses from hurricanes, floods, and wildfires intensified by climate change, major insurers have pulled back from offering home insurance in several regions, including Florida, Louisiana, Oklahoma, and New Mexico.

Insurance rates have spiked in response to increased risks, impacting housing markets. In Florida, home insurance rates are expected to average $15,460 this year, up from $14,140 last year. Similarly, Louisiana saw a 38 percent increase last year, with premiums on track to rise another 27 percent this year. Such high costs, coupled with high mortgage rates, are contributing to the softening of housing markets, where homes linger unsold for months.

Testing New Strategies

The recent Los Angeles wildfires serve as a real-world test for the new regulations. The Palisades and Easton fires resulted in 16,000 structures being incinerated, 30 fatalities, and an estimated $30 billion in insured losses. State Farm, the largest insurer in the state, applied for and received a 17 percent emergency rate hike. The insurer plans to seek another 11 percent increase this year, following substantial claims and payouts.

Meanwhile, California’s insurer of last resort required a $1 billion bailout after the fires, with insurers and their customers footing the bill. The situation highlights the urgent need for innovative solutions and legislative proposals to modernize insurance practices.

Innovative Solutions and Future Directions

Amidst the challenges, innovation is emerging. Start-ups like Delos Solutions are developing AI-based algorithms to assess wildfire risk profiles, offering insurance in areas abandoned by traditional insurers. The Nature Conservancy and partners have introduced a “wildfire resilience insurance policy” that considers fire mitigation efforts, resulting in significantly lower premiums and deductibles.

On the commercial side, Premiums for the Planet is steering insurance purchases away from companies insuring fossil fuel projects. According to Insure Our Future, U.S. insurers earned $21 billion from insuring fossil fuel companies in 2022. In California alone, insurers restricting property coverage due to extreme weather earned $3.6 billion from such projects.

“New fossil fuel projects literally cannot get off the ground without insurance,” said Nick Gardner, head of partnerships for Premiums for the Planet.

The ultimate solution lies in accelerating the transition away from fossil fuels. Dave Jones, director of the Climate Risk Initiative at UC Berkeley Law School, emphasized that rate hikes alone will not resolve the crisis. However, restricting development in high-risk areas remains politically challenging due to California’s housing shortage.

“We’ve got to be honest about stopping building in high-risk areas,” stated Kate Gordon, CEO of California Forward, at a recent climate forum.

As California grapples with these issues, the need for innovative solutions and policy changes becomes increasingly urgent. The state’s efforts could set a precedent for addressing climate-related insurance challenges nationwide.