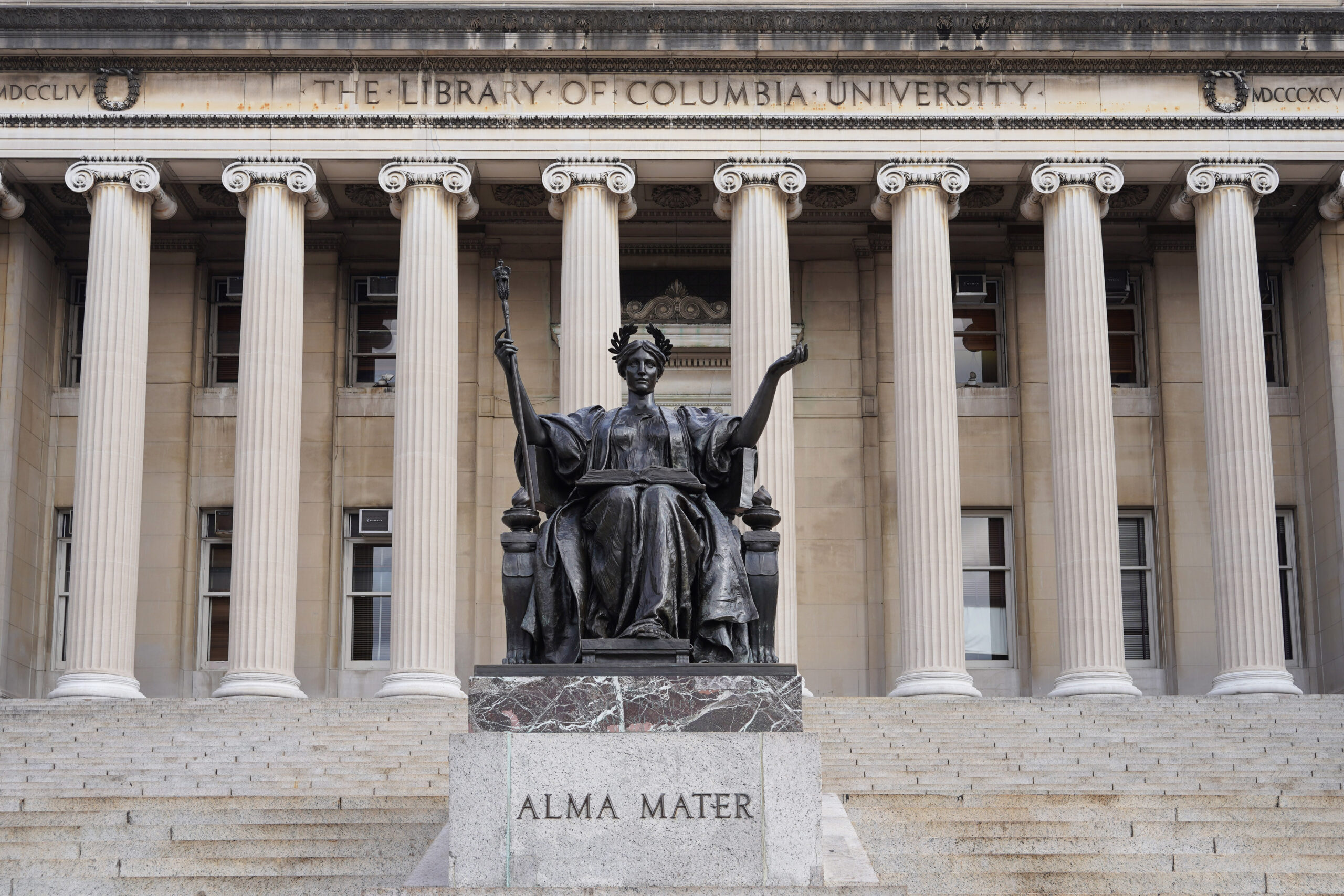

Biz2X, a provider of business lending solutions, has partnered with students and faculty from Columbia University to develop advanced agentic AI models aimed at facilitating loans for small businesses and assisting them in managing their finances. This collaboration leverages cutting-edge technology, utilizing Google’s Gemini large language model alongside cloud infrastructure from Amazon Web Services. The partnership is set to culminate in a comprehensive research paper detailing their findings.

Over recent years, Biz2X has successfully recruited numerous graduates from Columbia’s engineering and business schools. According to Rohit Arora, CEO of Biz2X, the objective is to elevate this collaboration and institutionalize it further, potentially attracting Fortune 500 companies such as Google and Amazon to participate.

Enhancing Financial Access Through AI

Jeffrey Sachs, a professor at Columbia University, emphasized the significance of this initiative, stating that the technology developed through this partnership could enhance access to finance for small enterprises. Such improvements are crucial for fostering innovation, job creation, and long-term resilience in both high-income and emerging economies.

For the past four months, graduate and PhD students from Columbia have been actively engaging with Biz2X’s operations, utilizing the company’s data and expertise. “They are collaborating with our data scientists, engineering team, and underwriters,” Arora explained. “They even participate in discussions with our clients.” Students involved in this program receive a stipend, and many could secure positions at Biz2X or within private credit firms once the academic year concludes.

David O’Connell, founder of O’Connell Lending Insights, noted that the collaboration addresses a critical lender shortage impacting both banks and their vendors. He highlighted the challenge of attracting new graduates to traditional lending roles, particularly in small business and commercial sectors. The lack of specialists in AI and data science exacerbates this issue. O’Connell remarked, “This partnership serves as a vital talent pipeline for Biz2X and other small business lending vendors in New York City.”

Applications of Agentic AI in Lending

The primary objective for the agentic AI models is to streamline workflows related to small business loan origination. This includes enhancing customer experience, underwriting, closing, funding, and portfolio monitoring. Arora outlined the process, stating that an underwriter evaluating a business must consider various factors such as cash flow and existing credit facilities. An AI agent can analyze these elements comprehensively, identifying patterns in applications regarding funding, pricing, repayment, and performance history.

“This approach allows us to create a sophisticated analysis that informs conversations between underwriters and borrowers,” Arora noted. “Current automation facilitates decision-making based on established rules. This advancement will connect various data channels, benchmark against existing data, and generate insightful summaries for underwriters.”

O’Connell concurred that small business lending presents an ideal application for agentic AI. He asserted that despite the current hype surrounding AI, it offers viable solutions to longstanding challenges in business lending. Given the numerous processes involved in small business loans, many of which do not necessitate extensive expertise, AI’s ability to scale, speed up, and improve efficiency is essential.

However, O’Connell cautioned that model developers must approach this innovation responsibly, particularly regarding disparate impact in lending practices. “Banks need to understand how every variable in their data models influences credit decisions to ensure fairness across different customer demographics,” he said.

Another significant application of agentic AI will enhance Biz2X’s Virtual CFO platform, a tool designed to assist small businesses in managing their cash flows. Arora illustrated this by stating, “A retail business must effectively manage its inventory, rent, and employee costs. For B2B firms, balancing accounts receivable and payable is crucial.” The agentic AI model will tailor the Virtual CFO platform to meet the specific needs of each business.

O’Connell pointed out that small business owners often juggle multiple responsibilities, which can lead to costly financial mistakes. “AI agents can provide timely prompts, such as advising against expensive payment methods,” he explained. “With a robust cohort of AI agents, the traditional role of a business banker could be rendered obsolete.”

A key objective of this initiative is to furnish private credit firms with detailed data about small businesses, enabling them to assess which enterprises warrant funding. “These firms are adept at understanding rated instruments, yet obtaining a rating in the small and medium-sized business (SMB) sector is often time-consuming and expensive,” Arora stated. Agentic AI could conduct this analysis instantaneously, enhancing the efficiency of the funding process.

Moreover, the application of agentic AI extends to portfolio monitoring. Arora highlighted that small business loans are directly influenced by Federal interest rate fluctuations, which can impact cash flow and overall performance.

O’Connell anticipates that collaborations similar to the one between Biz2X and Columbia University will become increasingly common. “The lender shortage poses the most significant hurdle to growth in business lending,” he asserted. “Attracting talent from competitors is often prohibitively expensive. Partnerships with academic institutions provide students with invaluable exposure to business lending, demystifying the sector and nurturing potential future talent.”

This partnership between Biz2X and Columbia University not only exemplifies the innovative spirit of academia and industry collaboration but also promises to reshape the landscape of small business lending, making it more accessible and efficient for entrepreneurs across various sectors.