UnitedHealth Group’s stock experienced a significant decline following reports of a Department of Justice (DOJ) investigation into the healthcare giant. The news prompted concerns regarding the company’s future, leading to a drop in investor confidence. Jared Holz, an analyst at Mizuho, discussed these developments on the financial program “Fast Money,” providing insights into the potential implications for the company.

Holz highlighted that the DOJ probe comes at a critical time for UnitedHealth, which has been navigating a complex landscape marked by regulatory scrutiny and market competition. He noted that the investigation could impact the company’s operations and financial performance, particularly if it leads to legal challenges or financial penalties.

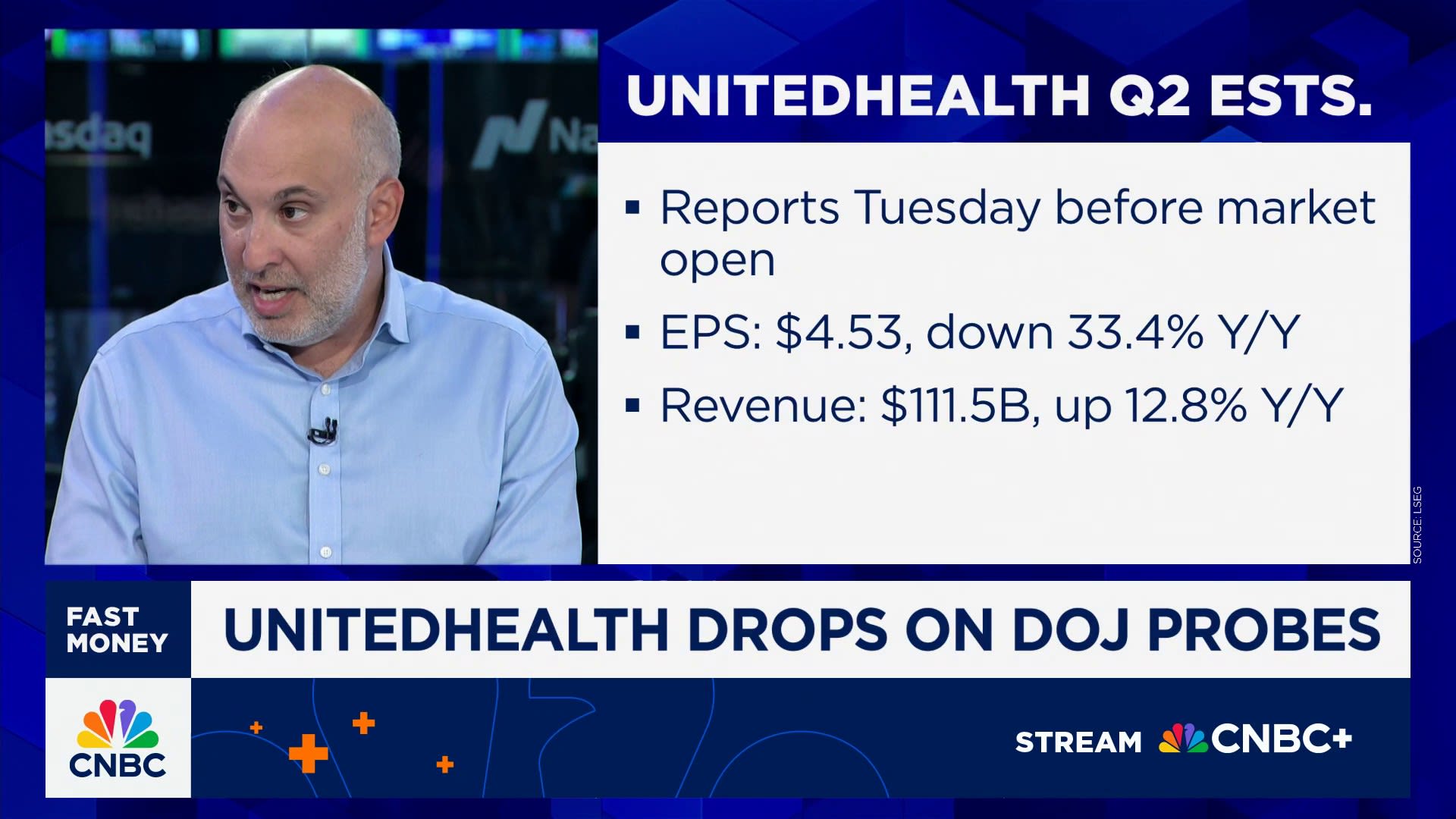

The stock fell sharply, underscoring the market’s reaction to the uncertainty surrounding the company’s dealings. According to recent trading data, UnitedHealth’s shares dropped by approximately 5% on October 23, 2023, reflecting investor apprehension. Holz emphasized that this decline may not only affect short-term market sentiment but could also have long-lasting implications if the investigation uncovers significant issues.

In his analysis, Holz pointed to the role of regulatory bodies like the DOJ in shaping the operational environment for large healthcare firms. The investigation reportedly focuses on potential violations related to fraud and abuse, which could have serious ramifications for UnitedHealth’s reputation and business model.

Investors are particularly concerned about the financial impact of such investigations. Holz indicated that if the DOJ finds substantial evidence of wrongdoing, the company could face hefty fines, which would affect its bottom line. The analyst urged stakeholders to closely monitor developments, as the outcome of the probe could lead to increased volatility in UnitedHealth’s stock price.

Additionally, Holz mentioned the broader implications for the healthcare sector as a whole. Increased regulatory oversight could signal a shift in how health insurers operate, potentially leading to tougher compliance requirements across the industry.

Looking ahead, Holz remains cautiously optimistic about UnitedHealth’s resilience, provided it can navigate this challenging period effectively. “The company has strong fundamentals and a diversified business model,” he stated, suggesting that a proactive approach to addressing the DOJ’s concerns could mitigate some of the negative impacts on investor sentiment.

As the situation unfolds, industry watchers will be keen to see how UnitedHealth responds to the investigation and what steps it will take to reassure investors. The outcome of the DOJ’s inquiry could reshape the company’s trajectory and influence the healthcare landscape.

In conclusion, the recent DOJ probe into UnitedHealth has sent ripples through the market, resulting in a notable decrease in its stock value. With analysts like Jared Holz weighing in on the potential consequences, stakeholders are advised to stay informed as the investigation progresses. The coming weeks may prove pivotal for UnitedHealth and its position within the healthcare industry.