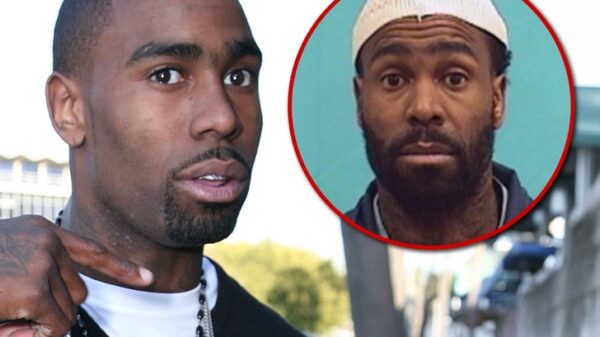

Two graduates of the prestigious Massachusetts Institute of Technology (MIT) were indicted in federal court for their alleged involvement in a cryptocurrency fraud scheme that netted approximately $25 million. The brothers, Anton and James Peraire-Bueno, face serious charges including conspiracy, wire fraud, and money laundering. Prosecutors describe the operation as a “first-of-its-kind” financial crime, according to Business Insider.

The trial commenced this week, with prosecutors detailing the scheme as a sophisticated “bait-and-switch” operation. Using automatic trading bots, the brothers allegedly manipulated crypto transactions, tricking other bots into exchanging vast sums for their fraudulent currency. “In 12 seconds, the defendants tricked their victims out of $25 million,” said Federal Assistant Attorney Ryan Nees during the proceedings. He emphasized that the primary aim of the brothers was to deceive others into purchasing what he referred to as “sh**coins.”

Prior to executing their scheme, the Peraire-Bueno brothers reportedly conducted extensive research online. They searched for terms including “how to wash crypto,” “top crypto lawyers,” and “money laundering statute of limitations,” indicating a calculated approach to their actions.

The brothers were arrested in May 2023 following a two-year federal investigation that uncovered their manipulation of protocols on the Ethereum blockchain, the second largest cryptocurrency by market capitalization. Their legal representatives argue that the brothers were not committing crimes but rather employing a novel trading strategy in an unregulated market. Defense attorney Patrick Looby stated that the absence of a central authority overseeing Ethereum’s transactions underscores the speculative nature of cryptocurrency trading.

As the case unfolds, it is poised to set a significant legal precedent regarding the extent of government authority to regulate the burgeoning cryptocurrency market, which currently boasts a total valuation exceeding $3.5 trillion.

The implications of this trial extend beyond the immediate charges against the Peraire-Bueno brothers, as it could shape future regulatory measures in a sector characterized by rapid innovation and a lack of comprehensive oversight.