In 2013, Motorola made an ambitious attempt to enter the competitive smartphone market, dominated by giants like Apple and Samsung, by assembling its devices in the United States. The initiative, branded with the phrase “Made in the USA,” aimed to attract consumers who preferred domestically produced products. However, this endeavor was short-lived, and Motorola discontinued its domestic assembly operations by 2014. Dennis Woodside, the former CEO of Motorola and current CEO of Freshworks, reflected on this experience, emphasizing the challenges companies face when attempting to manufacture smartphones in America today.

Woodside noted that while there was interest from consumers in American-made products, the operational realities proved daunting. He explained, “There was a segment of customers that said, ‘Hey, if you produce products in the United States, I’m more likely to consider them.’” Despite this interest, Motorola found it difficult to maintain production in Texas due to higher operational costs and a fragmented supply chain.

The company’s flagship phone, the Moto X, was assembled in Fort Worth, Texas, allowing for unique customizations that appealed to consumers. Through its website, customers could select features like button colors and back panel designs. Woodside stated, “To do that, you had to manufacture closer to the consumer.” Despite the appeal, the Moto X struggled in the market, with only 500,000 units sold in the third quarter of 2013, leading to the factory’s closure the following year.

The challenges faced by Motorola highlight broader issues affecting U.S. manufacturing. A significant hurdle is the scarcity of skilled workers. Woodside pointed out that attracting and retaining employees is particularly difficult when workers have alternative job options in retail or food service. He remarked, “There’s probably several hundred (phone) parts, and they’re tiny,” likening the assembly process to a “super tiny Lego set.”

The U.S. manufacturing sector has been grappling with a skills shortage, making it increasingly challenging to fill factory jobs. According to the U.S. Bureau of Labor Statistics, the sector lost an estimated 11,000 jobs between June and July 2024, highlighting the ongoing difficulties in workforce retention and training. A survey from the Cato Institute revealed that most Americans do not believe they would benefit from working in a factory compared to their current jobs.

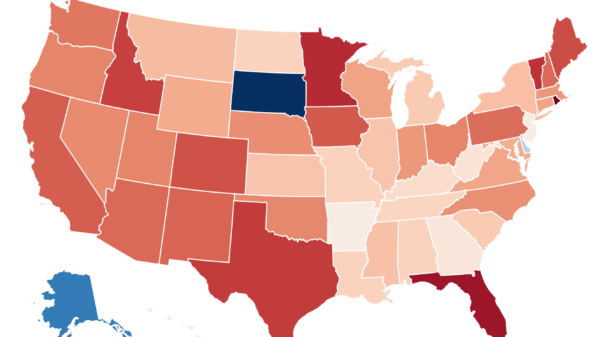

As international trade dynamics evolve, the pressure on companies to manufacture domestically has intensified. U.S. policymakers are advocating for increased production within the country, particularly as tariffs on imports from China loom. Starting August 12, 2024, higher levies on electronics assembled in China could impact companies like Apple and Samsung, prompting them to consider relocating production to the U.S.

India has emerged as a key player in the smartphone export market, recently surpassing China as the top exporter of smartphones to the United States. However, this shift comes with its own challenges, as Indian suppliers may also face tariffs of 25% when new rates take effect.

Woodside’s insights serve as a cautionary tale for companies considering U.S. smartphone production. He emphasizes that a strong value proposition is essential to attract skilled workers. “You have to be thoughtful about how you use automation and be really smart about all of the economics,” he advised.

Looking to the future, the U.S. manufacturing landscape is likely to evolve as new technologies, such as artificial intelligence and automation, play a larger role in production processes. Carolyn Lee, executive director of the Manufacturing Institute, noted that upcoming manufacturing jobs will require fresh skills, including coding and data analytics.

Ultimately, Woodside cautioned firms contemplating electronics manufacturing in the U.S. to thoroughly assess their ability to cultivate a qualified workforce. “Understanding the nature of the product you’re making and thinking about… ‘Are we going to have to completely train the workforce to understand this specific product?’” is critical, he advised.

As the conversation around domestic manufacturing continues, the lessons learned from Motorola’s experience in the smartphone market remain relevant, shedding light on the complexities of bringing production back to American soil.