Pfizer has secured a significant victory in the competitive pharmaceutical landscape by placing a $10 billion bid for obesity drug developer Metsera, surpassing an earlier offer from Danish rival Novo Nordisk. This acquisition aims to enhance Pfizer’s portfolio in the burgeoning obesity treatment market, which is currently dominated by Novo Nordisk’s popular weight loss medication, Wegovy.

Metsera’s board of directors announced late Friday that they have accepted Pfizer’s revised offer, which they believe presents the best option for shareholders. This decision comes amidst escalating tensions between Pfizer and Novo Nordisk, including potential lawsuits concerning the legality of Novo’s acquisition strategy. In a statement, Metsera highlighted that Pfizer’s bid not only provides considerable financial value but also brings greater certainty regarding the closing of the deal.

The Federal Trade Commission (FTC) has already approved Pfizer’s acquisition, but the transaction still requires the endorsement of Metsera’s shareholders. A special meeting is scheduled for November 13, 2023, where shareholders will vote on the Pfizer acquisition. The companies anticipate completing the deal shortly thereafter.

Novo Nordisk boasts a robust presence in the obesity treatment sector, primarily through its weekly injectable GLP-1 drug, Wegovy, along with Eli Lilly’s Zepbound, which are currently among the leading obesity medications available. In contrast, Pfizer has not yet launched any commercial obesity drugs, although it has some candidates in its pipeline that have faced setbacks in clinical trials.

The competition to develop next-generation obesity treatments is intensifying, with new drugs aimed at offering advantages such as less frequent dosing, lower manufacturing costs, and oral formulations. Metsera, which went public in early 2023 at $18 per share, has the potential to fulfill these market demands.

Pfizer’s winning offer breaks down to $65.60 in cash for each Metsera share, along with a contingent value right (CVR) that could yield up to an additional $20.65 per share if specific milestones are achieved. This latest bid represents a considerable increase from Pfizer’s initial offer of approximately $7.3 billion, which included $4.9 billion upfront and a CVR potentially worth $2.4 billion.

The bidding war reignited when Novo Nordisk made a higher unsolicited bid late last month, prompting Pfizer to file a lawsuit alleging breach of contract. The ensuing competition led both companies to enhance their proposals. Pfizer’s counteroffer totaled around $8.1 billion, while Novo Nordisk raised its offer to approximately $10 billion.

Novo’s improved proposal included a complex deal structure where it would pay $62.20 in cash for each Metsera share, coupled with non-voting preferred stock representing half of Metsera’s shares. Following regulatory approval, Novo would distribute a $62.20 per share dividend to Metsera shareholders and then acquire the remaining shares. However, Pfizer has challenged this structure in court, claiming it violates Delaware state law and raises antitrust concerns.

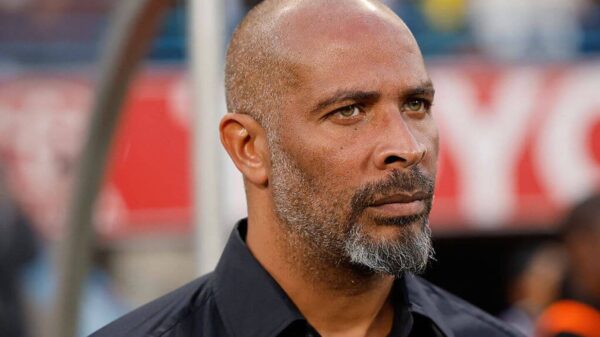

During a recent press conference, Novo Nordisk CEO Mike Doustdar addressed the ongoing bidding war, emphasizing that Novo’s position was advantageous. He stated, “Our message to Pfizer is that if they would like to buy the company, then put your hand in the pocket and bid higher.” Doustdar underscored the free market dynamics at play, asserting that the final price hinges on the seller’s valuation and the buyer’s willingness to pay.

Despite the competitive landscape, signs suggest that the FTC may be leaning in favor of Pfizer’s acquisition. Metsera acknowledged that the FTC had contacted the company regarding potential antitrust risks associated with Novo Nordisk’s proposed deal structure. In its statement, Metsera’s board expressed concerns that Novo’s offer posed “unacceptably high legal and regulatory risks” compared to Pfizer’s bid.

While Novo Nordisk remains confident in the legality of its deal structure, the company has stated it will not increase its offer, citing a commitment to financial discipline and shareholder value. Nevertheless, Novo Nordisk is not closing the door on future mergers and acquisitions, indicating that they will continue to explore business development opportunities.

As the pharmaceutical industry watches closely, the outcome of the vote on November 13 will significantly influence the landscape of obesity treatments and the competitive dynamics between these two industry giants.