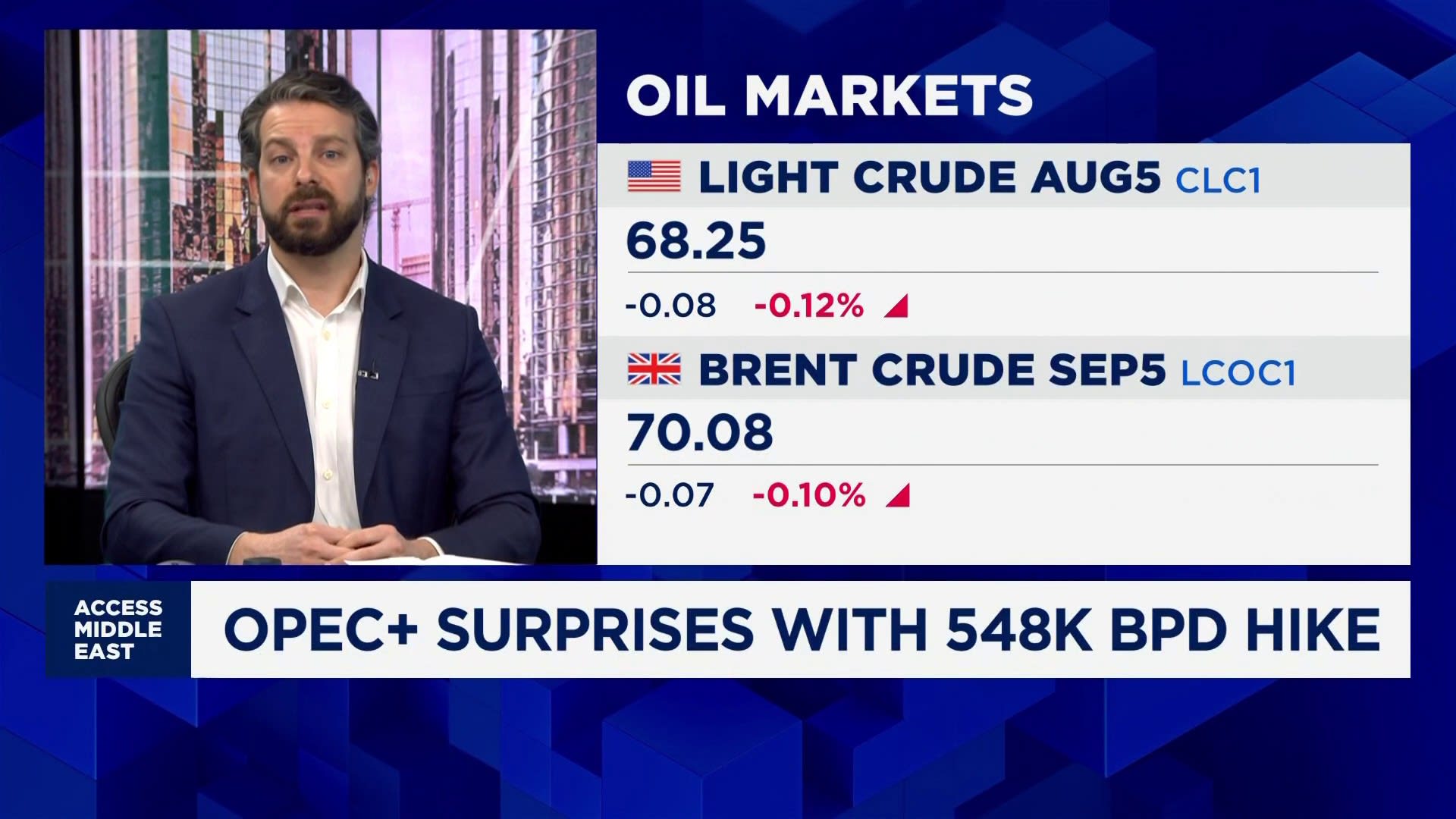

Analysts at Business Monitor International (BMI) have projected that oil prices will average $68 per barrel in 2025. The forecast suggests a slight increase to $72 per barrel by 2026, indicating a gradual recovery in the global oil market.

The report highlights several factors influencing these projections, including supply constraints and fluctuating demand patterns worldwide. As economies continue to rebound from the impacts of the COVID-19 pandemic, demand for oil is expected to increase, contributing to upward pressure on prices.

Market Influences on Oil Prices

BMI outlined that geopolitical tensions, particularly in oil-producing regions, will play a significant role in shaping market dynamics. Ongoing conflicts or instability in areas such as the Middle East can lead to supply disruptions, affecting global oil availability and subsequently impacting prices.

Additionally, the shift towards renewable energy sources is expected to influence long-term oil demand. While transitioning to greener alternatives is gaining momentum, BMI anticipates continued reliance on oil in the immediate future as industries adjust to new energy paradigms.

Implications for Global Economies

The projected average price of $68 per barrel in 2025 suggests that consumers and businesses may face increased costs, particularly in transportation and energy sectors. Countries heavily reliant on oil exports may benefit from elevated prices, enhancing their economic recovery prospects.

Conversely, nations that import significant amounts of oil might experience inflationary pressures, which could affect overall economic growth. Policymakers will need to navigate these challenges carefully, balancing economic recovery while addressing energy needs and environmental concerns.

As the oil market evolves, stakeholders will closely monitor these projections and their potential implications. With supply chains still recovering and global demand fluctuating, the situation remains dynamic, warranting ongoing analysis from industry experts.

This forecast serves as a significant indicator for businesses, governments, and investors as they plan for the future in a rapidly changing energy landscape.