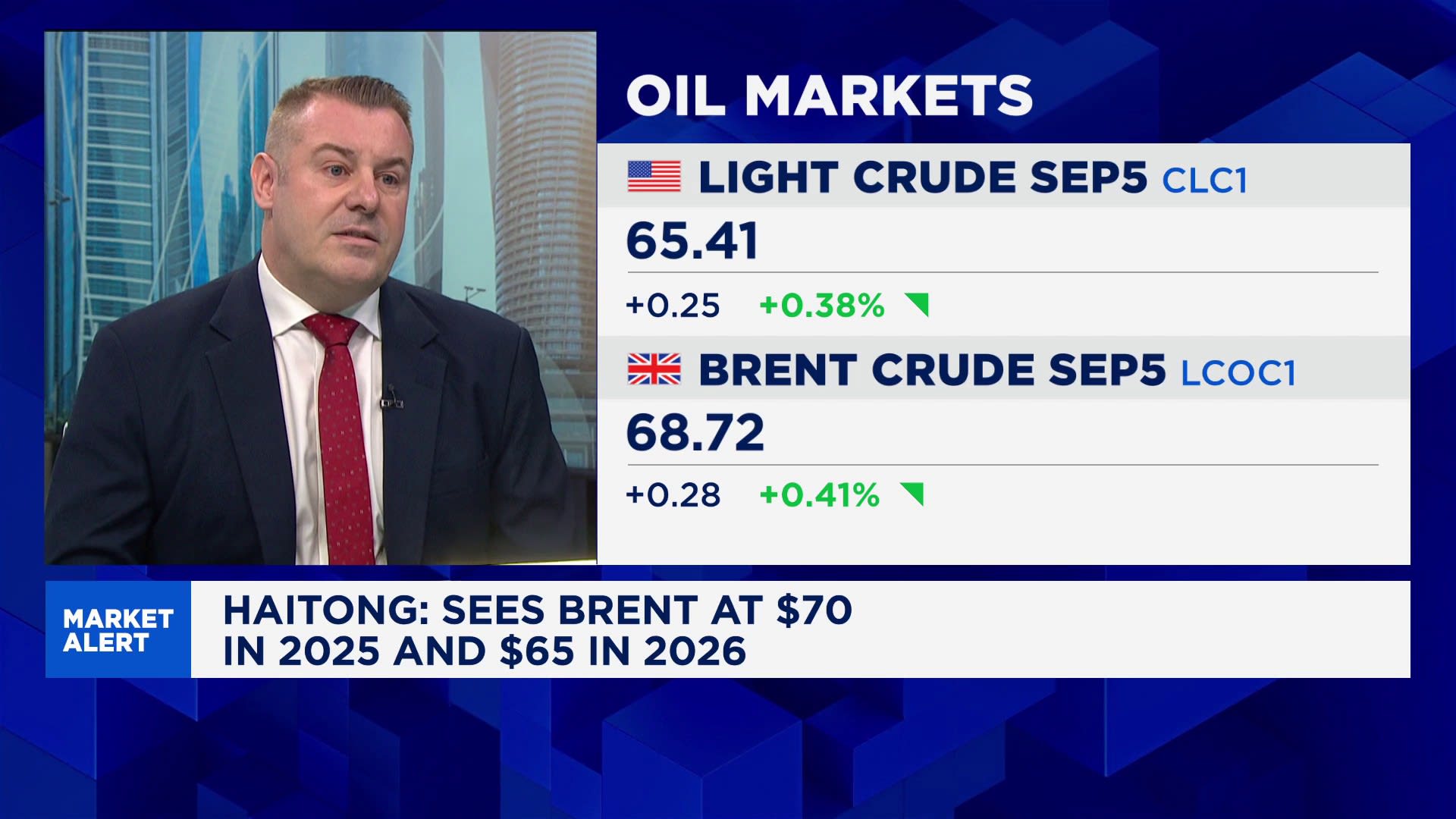

Oil prices are projected to decline due to a significant decrease in global demand, according to a report from Haitong International Securities. The firm indicates that both Brent crude and WTI crude prices will face downward pressure as economic conditions shift in various regions.

As of the latest data, Brent crude is hovering around $85 per barrel, while WTI crude is at approximately $80 per barrel. Analysts at Haitong attribute this anticipated price fall to weaker consumption patterns, particularly in key markets such as Asia and Europe. The report highlights that factors such as slowing economic growth and rising inflation rates are contributing to reduced oil demand.

Impacts of Economic Slowdown on Oil Demand

The forecast by Haitong comes in the context of a broader economic slowdown. Many industries are experiencing a contraction, leading to lower energy consumption. The International Energy Agency has also noted that demand in 2023 will not reach previous highs, which could further exacerbate price declines.

In the United States, ongoing interest rate hikes have tempered consumer spending, contributing to a slowdown in demand for oil products. This trend is mirrored in Europe, where energy costs have surged, prompting consumers to reduce their usage.

Haitong’s analysis suggests that if these trends continue, oil prices could see a reduction of up to 10% in the coming months. The firm emphasizes that if demand does not rebound, producers may need to adjust their output levels to maintain price stability.

Potential Reactions from OPEC

The Organization of the Petroleum Exporting Countries (OPEC) may respond to these market signals. In recent months, OPEC has been cautious with production levels, attempting to balance supply with demand to avoid price volatility. Should the forecasts from Haitong materialize, OPEC might consider further production cuts to support prices.

The report also indicates that geopolitical factors could play a role in future price movements. Tensions in oil-rich regions, alongside fluctuating global trade dynamics, might influence the market landscape.

In conclusion, the projections made by Haitong highlight a significant shift in the oil market, driven primarily by reduced global demand. Stakeholders in the energy sector will be closely monitoring these developments, as the implications could reverberate across economies worldwide.