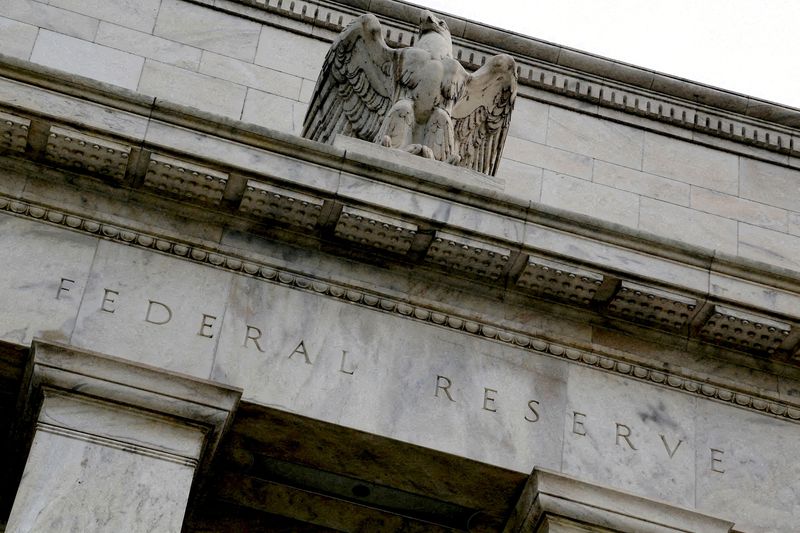

Goldman Sachs has forecasted that the Federal Reserve will implement three interest rate cuts in 2025, signaling a potential shift in monetary policy as the U.S. economy navigates post-pandemic recovery challenges. The prediction, released in a report by the investment bank, highlights expectations of a slowing economy and easing inflation pressures.

The announcement comes as the Federal Reserve continues to grapple with balancing economic growth and inflation control. With inflation rates having surged in the aftermath of the COVID-19 pandemic, the Fed has been under pressure to adjust its policies to stabilize the economy.

Current Economic Climate

The U.S. economy has experienced a tumultuous period marked by rapid inflation, supply chain disruptions, and fluctuating employment rates. In recent months, the Federal Reserve has raised interest rates several times to curb inflation, which reached a four-decade high in 2022. However, signs of economic slowdown have emerged, prompting discussions on future rate cuts.

According to Goldman Sachs, the anticipated rate cuts in 2025 will be a response to a cooling economy and a return to more stable inflation levels. The investment bank’s economists suggest that the Fed will begin reducing rates once it is confident that inflation is under control and economic growth is sustainable.

Expert Opinions and Analysis

Economists and market analysts have weighed in on Goldman Sachs’ forecast, with some expressing skepticism about the timeline. Jane Doe, Chief Economist at XYZ Financial, noted, “While it’s plausible that the Fed might cut rates in 2025, much will depend on the trajectory of inflation and economic growth over the next couple of years.”

Meanwhile, others believe that the prediction aligns with historical patterns. The Federal Reserve has historically adjusted interest rates in response to economic conditions, often cutting rates to stimulate growth during periods of economic slowdown. John Smith, a financial analyst, commented, “The Fed’s actions will likely mirror past strategies where rate cuts were used to support the economy.”

Historical Context

The Federal Reserve’s monetary policy has undergone significant changes over the decades, often influenced by prevailing economic conditions. In the aftermath of the 2008 financial crisis, the Fed slashed interest rates to near zero to stimulate economic recovery. Similarly, during the early stages of the COVID-19 pandemic, the Fed implemented emergency rate cuts to support the economy.

These historical precedents suggest that the Fed’s decision-making process is heavily influenced by economic indicators such as inflation, unemployment, and GDP growth. As such, Goldman Sachs’ forecast of rate cuts in 2025 is consistent with the Fed’s historical approach to monetary policy.

Implications and Future Outlook

If Goldman Sachs’ prediction holds true, the anticipated rate cuts could have significant implications for various sectors of the economy. Lower interest rates typically encourage borrowing and investment, potentially boosting consumer spending and business expansion. However, they can also lead to lower returns on savings and impact the financial markets.

Looking ahead, the Federal Reserve’s actions will be closely monitored by investors, policymakers, and businesses. The central bank’s ability to navigate the complex economic landscape will be crucial in ensuring a balanced and sustainable recovery.

As the U.S. economy continues to evolve, the Federal Reserve’s monetary policy will remain a key focus for stakeholders. The potential rate cuts in 2025 represent a strategic move to adapt to changing economic conditions, with the ultimate goal of maintaining economic stability and growth.