Ford Motor Company has unveiled its ambitious Universal EV Platform, positioning it as a pivotal moment similar to the launch of the iconic Model T. During a presentation on August 15, 2025, CEO Jim Farley emphasized the platform’s goal of producing affordable electric vehicles (EVs) at scale, supported by streamlined manufacturing processes and domestically produced LFP batteries. The automaker has committed $5 billion to this initiative, although Farley candidly acknowledged the risks involved, stating he could not guarantee its success amid shifting political and economic landscapes.

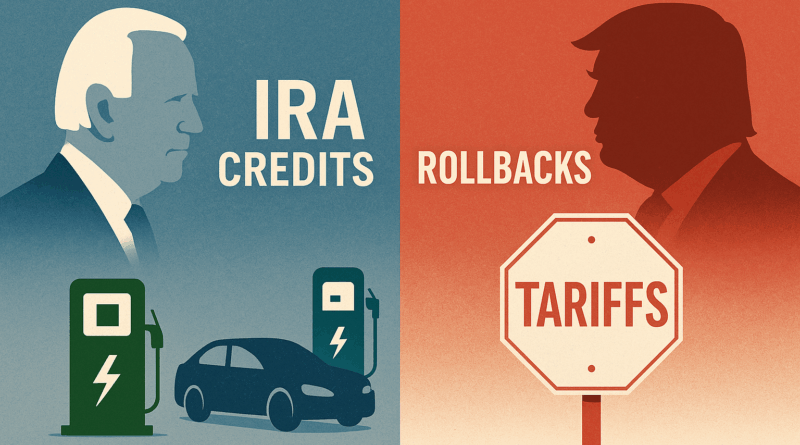

As the U.S. grapples with a challenging policy environment, Ford’s strategy seems both bold and precarious. The company is banking on its cost-cutting innovations while anticipating a potential political shift that may favor electrification again. The groundwork for the Universal EV Platform was laid during a time when policies supported EV development, particularly under the Biden administration’s Inflation Reduction Act, which provided significant consumer credits and manufacturing incentives.

Strategic Vision and Market Dynamics

The foundational diagnosis for Ford’s strategy was robust. In 2022, development began in a California skunkworks project, allowing the company to operate outside its traditional development framework. By 2024, the favorable policy climate saw the company committing to the Universal EV Platform with a clear product vision: affordable EVs built with fewer components, faster assembly, and local battery production. This strategy aimed to lower the total cost of ownership compared to gasoline vehicles, addressing what Ford’s leadership identified as the primary barrier to widespread EV adoption—cost.

The guiding policy was straightforward. Ford intended to invest in advanced manufacturing techniques, localizing critical supply chains, and preparing to deliver mass-market EVs. The coherent actions involved reducing parts by 20%, cutting fasteners by 25%, and employing large one-piece castings to minimize complexity. Additionally, the new zonal electrical architecture simplified wiring, enhancing reliability and reducing failure points.

Yet, as of August 2025, the political climate has shifted. The Trump administration has eliminated the consumer EV credit and rolled back funding for charging infrastructure. Tariffs on imported steel and aluminum have also increased manufacturing costs, directly impacting the pricing strategy for the Universal EV Platform. These changes pose significant challenges for a platform designed to deliver affordable vehicles to a price-sensitive market.

Challenges Ahead for the Universal EV Platform

Ford’s decision to proceed with the Universal EV Platform under these conditions suggests a strategic gamble. The company appears to be betting that the current political landscape is temporary and that supportive policies will return before the first vehicles from the platform reach the market in volume. Despite the headwinds, Ford continues to invest in tooling and battery plants, reflecting a coherent choice based on internal assessments of future policy shifts.

The engineering behind the Universal EV Platform is impressive, featuring LFP battery packs produced in Michigan to ensure cost efficiency and supply security. The assembly process has been reimagined to allow for parallel construction of vehicle modules, which enhances production speed. However, a significant concern remains regarding the platform’s range capabilities. The base battery pack, with a capacity of approximately 51 kWh, may suffice in urban environments but falls short for American consumers accustomed to long-distance travel and variable charging infrastructure.

Furthermore, the platform’s design may not translate well outside North America, where vehicle dimensions and range expectations differ significantly. Competing brands, such as BYD, offer longer-range EVs at competitive prices, which could limit the Universal EV Platform’s appeal in international markets.

Despite these obstacles, the platform holds promise in the commercial vehicle sector. Fleet operators, including utilities and delivery services, may find value in the platform’s lower total cost of ownership and simplified manufacturing process. The ability to adapt the platform for various commercial applications could mitigate some of the challenges posed by range limitations.

As Ford advances its strategy, competition from other automakers remains a critical factor. Companies like Tesla, General Motors, and Toyota are also vying for market share with their own innovative products and cost-reduction strategies. Each competitor is preparing to meet the demand for affordable, reliable EVs as the market evolves.

In summary, while Ford is making a substantial investment in the Universal EV Platform, the shifting policy landscape presents significant challenges. The alignment of diagnosis, guiding policy, and coherent actions was initially strong, but recent developments have complicated the outlook. Ford must navigate these complexities effectively to capitalize on its investment and ensure the platform’s success in an increasingly competitive market.