The rise of synthetic media, particularly deepfakes, is significantly impacting financial markets. Manipulated videos, voice clones, and false headlines threaten equities, trading sentiment, and corporate credibility. Regulatory frameworks, such as the EU AI Act and guidance from FinCEN, now require labeling for deepfakes, enhanced monitoring, and measures to counter synthetic media fraud. As the sophistication of these technologies increases, market analytics teams face the pressing challenge of integrating robust defenses against these risks.

Deepfakes have transitioned from a novelty to a serious concern, with their ability to impersonate individuals and forge credible information at an alarming pace. Recent statistics indicate that financial losses linked to deepfake attacks surpassed $200 million in the first quarter of 2025 alone. Furthermore, incidents of manipulated media have already caused brief volatility in equities, prompting urgent calls for caution from regulators and market experts.

Understanding the Risks of Deepfakes

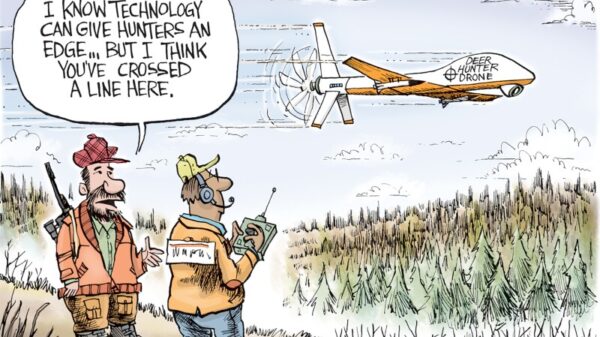

Three critical trends have converged, amplifying the risks associated with deepfakes. First, advancements in technology enable the cloning of voices from mere seconds of audio, alongside the generation of live, lip-synced video. Second, the financial motivation behind deepfake attacks has surged, leading to a proliferation of scams targeting investors and financial institutions. Third, documented instances of deepfake-induced market disruptions illustrate the tangible threat posed by this technology.

For example, in early 2024, a Hong Kong finance professional was deceived during a video call featuring deepfaked colleagues. This incident resulted in a fraudulent transfer of $25 million, highlighting how sophisticated impersonation can lead to significant financial losses. Moreover, senior officials and celebrities have had their likenesses exploited to endorse fraudulent investment schemes, showcasing the ease with which trust can be manipulated.

Regulatory Frameworks and Market Responses

The policy landscape surrounding deepfakes is rapidly evolving. The EU AI Act, set to be implemented in 2024 and 2025, mandates that synthetic media be clearly labeled and embedded with machine-readable signals to ensure transparency. In the United States, FinCEN has alerted financial institutions to the risks associated with deepfakes and has called for enhanced monitoring and reporting mechanisms. Several states have also enacted laws addressing deepfake technology, while platforms like Meta are working to label AI-generated content.

As these regulations take effect, market analytics teams must adapt their strategies to safeguard against the risks posed by synthetic media. Traditional analytics pipelines that ingest data from press releases, earnings calls, and social media are now vulnerable to adversarial inputs. The high-risk entry points include fake earnings calls that can distort market sentiment and synthetic headlines that bypass filters, leading to misinterpretations by trading algorithms.

To combat these threats, firms can employ a multi-faceted defense strategy. This includes limiting market-moving data to verified sources and integrating C2PA standards for content authenticity. Companies should prioritize vendors that utilize cryptographic signatures and implement thorough verification processes for all incoming media. Additionally, a comprehensive approach to layered authenticity scoring, combining various detection methods and human oversight, is essential for maintaining the integrity of market analytics.

Training and human awareness are also crucial components in this evolving landscape. Scenario-based drills that simulate deepfake incidents can effectively prepare analytics teams to respond to potential threats. The UK FCA has identified gaps in current training protocols, emphasizing the need for ongoing education to recognize red flags associated with synthetic media.

The growing prevalence of deepfakes represents a significant challenge for financial markets. As technology continues to advance, organizations must remain vigilant and proactive in their efforts to detect and mitigate risks. By adopting a provenance-first approach and ensuring robust human oversight, market analytics teams can navigate the complexities of synthetic media while preserving the integrity of financial information.

In conclusion, deepfakes are reshaping the landscape of financial market analytics. As incidents of manipulation become more frequent and losses more substantial, the imperative for organizations to enhance their defenses has never been clearer. Emphasizing verification, transparency, and human intervention will be key to thriving in an environment where the information itself can be adversarial.