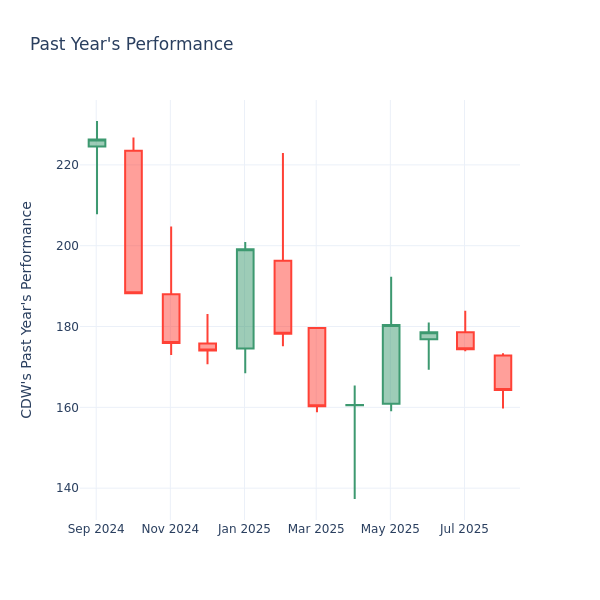

In the latest trading session, CDW Inc. experienced a notable increase of 2.59%, bringing its stock price to $164.29. Despite this recent uptick, the company’s stock has faced challenges, having decreased by 6.53% over the last month and a significant 24.18% over the past year. This decline raises questions for shareholders regarding the stock’s current valuation and future performance potential.

Investors often utilize the price-to-earnings (P/E) ratio to assess whether a company’s stock is overvalued or undervalued. The P/E ratio compares a company’s current share price to its earnings per share (EPS), providing a snapshot of its market performance relative to historical data and industry standards. A higher P/E ratio typically suggests that investors expect better future performance, potentially indicating an overvaluation. Conversely, a lower P/E might signal that the stock is undervalued or that investors have a muted outlook on future growth.

CDW’s P/E Ratio in Industry Context

CDW’s current P/E ratio stands at 19.92, which is significantly lower than the industry average of 36.6 for the Electronic Equipment, Instruments & Components sector. This disparity might lead shareholders to question whether CDW is positioned to perform worse than its industry peers or if it is currently an undervalued opportunity.

In analyzing these metrics, it is essential to consider that while a lower P/E ratio can imply undervaluation, it may also reflect a lack of investor confidence in future growth prospects. The P/E ratio should not be assessed in isolation; broader industry trends, economic conditions, and company-specific factors can all influence stock performance.

Investors are encouraged to combine the P/E ratio with other financial indicators and qualitative assessments to form a comprehensive view of CDW’s market position. As the company navigates the current market landscape, understanding these dynamics will be crucial for making informed investment choices.

In summary, while CDW’s recent stock rise offers a glimmer of hope amid ongoing volatility, the broader context of its P/E ratio compared to industry peers provides valuable insights for shareholders aiming to gauge the company’s potential trajectory in the coming months.