In a shifting banking landscape, a focus on environmental, social, and governance (ESG) strategies is becoming essential for banks seeking growth and sustainability. As institutions adjust to evolving global regulations and market demands, they are recognizing that sustainability is not merely a trend but a critical factor for survival. Climate risk, digital disruptions, and changing consumer expectations are compelling banks to rethink their operational frameworks.

Banks are currently faced with the challenge of balancing the demands of various stakeholders. Investors are calling for long-term stability, regulators urge transparency, and customers seek purpose-driven brands. Ignoring ESG imperatives may satisfy one group but could alienate others critical for future growth. According to a recent report from the Conference Board, only 6% of companies are making significant changes to their ESG policies, highlighting the gap between rhetoric and action.

Integrating Sustainability into Core Strategies

For banks, integrating sustainability into core strategies is no longer optional; it is a strategic imperative. The financial sector is undergoing profound changes as climate risks and regulatory pressures reshape the operating environment. Physical threats from climate change now pose real risks to banking infrastructure and loan portfolios, prompting institutions to reassess exposure and risk management strategies.

Regulators across various jurisdictions are demanding increased accountability and transparency in how banks address sustainability issues. Additionally, fintechs and neobanks, which often operate without legacy systems, are setting new benchmarks for ESG alignment and customer engagement. As these agile competitors gain market share, traditional banks face a critical moment for transformation.

The path forward involves treating sustainability as an ongoing strategic journey rather than a compliance requirement. Investors, regulators, and customers now expect measurable progress in ESG initiatives. This translates to embedding resilience into core operations. For instance, banks that invest in climate-resilient infrastructure, such as robust IT systems and sustainable buildings, can better shield their assets from severe weather while capturing long-term value. The World Bank estimates that every $1 trillion invested in resilient infrastructure can yield approximately $4.2 trillion in benefits.

Driving Efficiency Through Digital Transformation

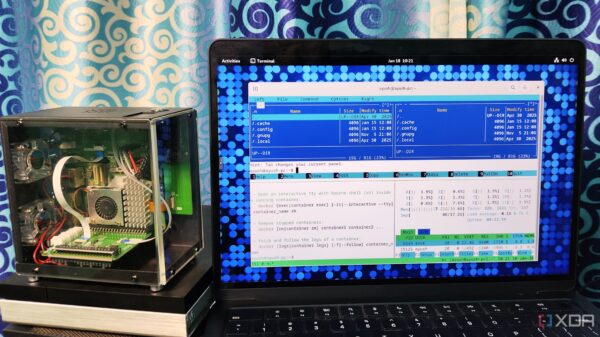

Modernizing infrastructure is a key enabler of sustainability. Transitioning from outdated systems to cloud-based, modular platforms significantly enhances operational efficiency and reduces energy consumption. Banks that have adopted cloud solutions report up to 60% cost savings compared to traditional systems, allowing for further investment in innovative and green initiatives.

Additionally, deploying energy-efficient hardware and real-time monitoring tools can drastically reduce power demand. This means shifting workloads to cloud data centers increasingly powered by renewable energy and utilizing low-power devices. Such digital transformation not only minimizes physical and carbon footprints but also establishes a solid data foundation for effective ESG reporting and risk analysis.

Looking ahead, adaptive risk management should be a priority for banks. Incorporating climate and ESG factors into credit approvals, stress tests, and capital planning will be essential. For example, assigning clear resilience and transition metrics to loans and investments can help leading banks proactively fund climate-resilient projects and identify new lending opportunities.

Furthermore, banks must prioritize operational transformation. By modernizing IT and branch networks to be more energy-efficient, they can significantly reduce costs and environmental impacts. Cloud-native architectures can drastically lower IT energy use while enhancing agility in launching innovative financial services.

In addition, a focus on governance and cultural change is essential. Banks should embed sustainability into corporate governance by establishing clear ESG goals aligned with frameworks like the U.N. Sustainable Development Goals and linking them to executive performance. Industry surveys indicate that most C-suite leaders now recognize no conflict between business success and social purpose, reinforcing the need for alignment in product development, lending criteria, and transparent communication of progress.

As banks proactively adapt to climate and societal shifts, modernize their infrastructure, and integrate ESG into decision-making processes, they can enhance resilience and unlock new growth opportunities. Sustainability is not just a trend; it is a strategic necessity that will define the future of banking. Institutions that act decisively now will build stronger portfolios, healthier balance sheets, and greater trust among stakeholders in the long run.