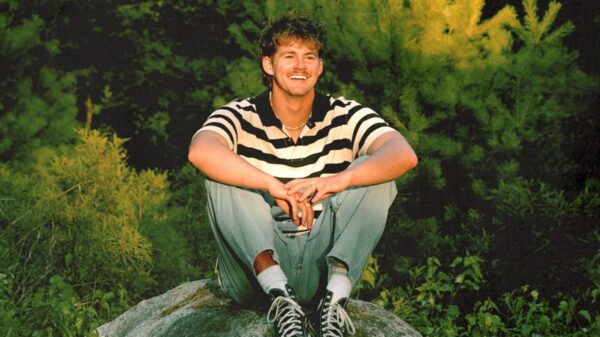

Evolve Bank & Trust has appointed Robert Hartheimer as its new CEO, effective immediately. This announcement, made on Wednesday, comes at a critical time for the Memphis, Tennessee-based bank, which is currently navigating a June 2024 cease-and-desist order from the Federal Reserve and the fallout from the recent collapse of its fintech partner, Synapse.

The challenges facing Hartheimer are significant, as the bank grapples with compliance issues and reputational damage stemming from the Synapse incident. Hartheimer’s experience positions him uniquely to address these difficulties. According to Sarah Bloom Raskin, a former Federal Reserve Board governor and current Duke Law School professor, Hartheimer has a track record of navigating troubled financial institutions. Raskin noted his previous work with the FDIC, where he established a division to help prepare over 200 distressed banks for sale.

Hartheimer’s primary task will be to restore Evolve’s standing in the wake of the Synapse bankruptcy, which was filed in April 2024. This event highlighted a significant financial discrepancy, with estimates indicating a shortfall of between $65 million and $95 million in customer funds. The fallout has led to multiple lawsuits, including one from fintech customer Yotta, which accused Evolve of mismanagement and operating a Ponzi scheme.

“Many customers of Evolve have lost faith and so lost the ability to feel good about this bank,” Raskin remarked, emphasizing the uphill battle Hartheimer faces in rebuilding trust. Evolve has stated that it has moved most of its customer accounts from Synapse to three other partner banks—Lineage Bank, AMG National Trust, and American Bank—and insists that there was no shortfall at the time of the transfer. The bank claims that inaccuracies in Synapse’s ledgers complicated fund tracking.

In response to the situation, Hartheimer defended Evolve’s actions, stating, “We have been a Boy Scout in the Synapse matter.” He highlighted the bank’s investment in reconstructing financial records and expressed hope for collaboration with other banks in the Synapse ecosystem to reconcile discrepancies.

The Synapse collapse has prompted a broader reassessment of compliance practices across the banking-as-a-service (BaaS) sector. Hartheimer noted, “This is not uncommon in the banking business: new ways of doing things occur, and then there’s a catch-up on how those businesses need to be managed and overseen.” He emphasized that all BaaS banks are now undergoing more stringent compliance and risk management changes.

Under the Federal Reserve’s cease-and-desist order, Evolve faces restrictions in onboarding new open banking clients. Hartheimer acknowledged the challenges but expressed confidence in the bank’s liquidity and capital position, stating, “It has plenty of liquidity. This is not a bank that is forced to do anything.” He aims to enhance Evolve’s technology and services in the fintech sector, aspiring for the bank to emerge as a leader by 2026.

Evolve’s Board Chairman, Steve Valentine, characterized Hartheimer’s appointment as a pivotal moment for the bank. He stated, “Bob was selected for his unmatched corporate experience in strategically navigating challenges at financial institutions and enabling banks to move past their regulatory challenges.” Valentine emphasized the board’s commitment to fostering transparency and sustainable growth, reinforcing the need to rebuild trust among customers, employees, and regulators.

As Hartheimer steps into this leadership role, former colleagues have voiced strong support. Michelle Alt, a partner at Klaros Group, remarked, “Bob is a highly experienced bank leader and regulatory expert. I have every confidence in his ability to lead the bank.”

Evolve Bank & Trust is not only navigating its banking-as-a-service operations but also manages a trust business, a mortgage division, and regional lending operations in eastern Arkansas and western Tennessee. Hartheimer is optimistic about these areas, asserting that they have historically performed well and will continue to expand.

Moving forward, Hartheimer’s leadership will be critical in addressing the bank’s current challenges and positioning it for future growth in the evolving financial landscape.