Skyward Specialty Insurance Group, Inc. (NASDAQ: SKWD) reported robust financial results for the second quarter of 2025, highlighting a significant increase in adjusted operating income and gross written premiums. On August 1, 2025, the company announced an adjusted operating income of $37.1 million, translating to $0.89 per diluted share. This strong performance was largely driven by a record $31.2 million in pretax underwriting income, marking the highest in the company’s history.

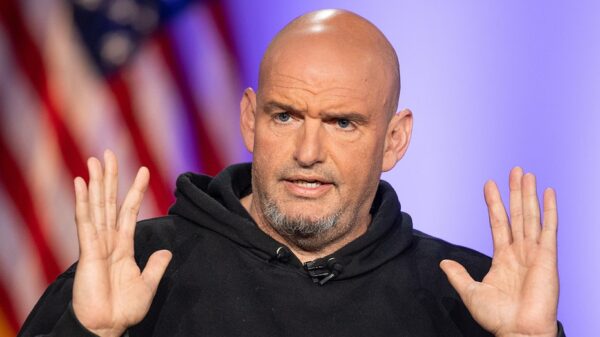

During the earnings call, Andrew Scott Robinson, Chairman and Chief Executive Officer, emphasized the company’s strategic focus and disciplined approach to underwriting. The year-to-date annualized return on equity stood at an impressive 19.1%. Furthermore, gross written premiums grew by 18% for the quarter, while the combined ratio improved to 89.4%, which reflects effective risk management and operational execution.

Financial Insights and Strategic Focus

In his remarks, Robinson noted that the diversified portfolio and execution of their “Rule Our Niche” strategy enabled them to achieve these results. He stated, “Our growth this quarter is particularly notable as we pulled back in global and E&S property in response to increasingly softening conditions.” The company opted to maintain its current liability exposure, despite a generally positive rate environment, due to concerns over loss inflation.

Chief Financial Officer Mark William Haushill detailed additional financial metrics, reporting a net income of $38.8 million or $0.93 per diluted share. Net written premiums saw a 14% increase, while the net retention rate remained consistent at 60.9%, slightly down from the previous year’s 61.2%. The second-quarter combined ratio included 1.4 points of catastrophe losses, mainly from severe weather events in the southern and midwestern United States.

Haushill also highlighted that the non-catastrophe loss ratio improved to 59.9%, the best in the company’s history. Despite observing trends in auto liability and general liability severity, he noted the company’s focus on selective growth opportunities in less volatile segments.

Growth Areas and Market Adaptation

Robinson pointed out that the company is well-positioned to adapt and reallocate capital effectively across its portfolio. Notable growth segments include agriculture, credit, and accident & health (A&H) insurance. He remarked, “We are built not just for today’s environment, but for all cycles to deliver long-term outperformance.”

Skyward Specialty’s strategy in agriculture remains particularly robust, as the company targets markets with government-subsidized programs. The CEO expressed optimism regarding new opportunities in the U.S. dairy and livestock sectors. In the A&H division, the company has seen continued success driven by a group captive offering tailored for the medical stop-loss market, which serves smaller accounts with fewer than 500 lives.

On the investment side, despite a reduction in investment income to $18.6 million, the company managed to increase its fixed income portfolio’s yield. The overall investment strategy is geared towards minimizing exposure to high-volatility assets while enhancing income through conservative fixed income investments.

Looking ahead, Robinson reiterated the company’s commitment to its strategic vision, stating, “Our Rule Our Niche strategy is not just a tagline. It is a blueprint for durable top quartile performance through the market cycles.” The leadership remains confident in navigating current challenges while continuing to seek profitable growth opportunities across various sectors.

Skyward Specialty Insurance’s strong quarterly performance underscores its effective management and adaptability in a dynamic market environment, positioning the company favorably for future growth.