Voyager Technologies, Inc. (VOYG) has attracted attention from investors with a bullish investment thesis, highlighted by a user named T0YPAJ182 on ValueInvestorsClub.com. As of November 28, 2023, VOYG shares were trading at $22.48, reflecting strong potential in both defense and commercial space sectors.

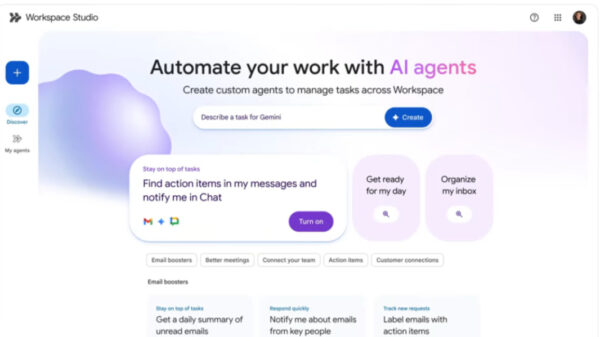

Voyager Technologies operates with a dual focus on national security and space exploration. Its operations include a subcontracting division that supports defense contracts and the development of Starlab, a commercial space station anticipated to replace the International Space Station (ISS) by 2030. The defense segment generates most of the company’s near-term revenue, supplying propulsion systems for Lockheed Martin’s Next Generation Interceptor (NGI) missile program. Additionally, Voyager provides intelligence, surveillance, reconnaissance (ISR) solutions and artificial intelligence/machine learning (AI/ML) software, alongside space infrastructure services.

The company’s growth prospects are bolstered by a robust pipeline of programs valued at approximately $2.7 billion. Management expects to onboard a second significant program by 2026, enhancing the company’s growth trajectory. Strategic acquisitions, including Nanoracks, Valley Tech Systems, and BridgeComm, have created a cohesive technology stack that strengthens execution and credibility.

Long-Term Vision and Strategic Partnerships

In the longer term, Voyager’s stake in Starlab, valued at around $3 billion and representing over 67% ownership, offers substantial upside potential. This commercial space station is designed to support astronaut services and facilitate commercial research, positioning Voyager as an innovative leader in the space sector.

The company has formed strategic partnerships with major players including Airbus, Mitsubishi, MDA Space, and Palantir. These alliances provide operational advantages, enhancing Voyager’s competitive stance against rivals such as Axiom Space, Blue Origin, and Vast Space. Despite market volatility driven by funding mechanisms and procurement adjustments from NASA, Voyager’s solid execution history and depth of its program pipeline lend credibility to its investment case.

Using a sum-of-the-parts valuation, analysts value Voyager’s core business at 7.5 times one-year forward sales, with Starlab contributing additional call-option value. This analysis suggests a price target of $58, with a bullish scenario estimating a price of $84 within two years. Key catalysts for this growth include funding announcements for Starlab, clarity on the Golden Dome request for proposals, additional defense program awards, and elevated strategic valuations.

Market Position and Investment Considerations

As of the end of the second quarter of 2023, 34 hedge fund portfolios held shares of Voyager Technologies, a notable increase from none in the previous quarter. This reflects growing interest in the stock, although it is not currently among the 30 Most Popular Stocks Among Hedge Funds.

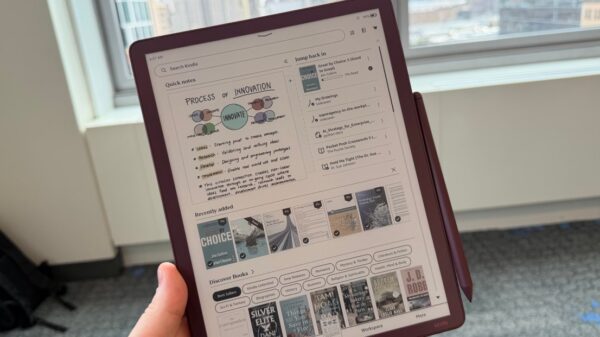

While the potential of Voyager Technologies is recognized, some analysts express a preference for AI-focused stocks that promise higher returns within a shorter timeframe. Investors are encouraged to consider various options in the market, including those with significant upside potential.

In summary, Voyager Technologies, Inc. presents an intriguing investment opportunity with immediate exposure to defense growth and transformative long-term prospects in the commercial space sector. As the company navigates its operational landscape, it remains to be seen how effectively it can leverage its strategic partnerships and technological advancements to fulfill its ambitious goals.