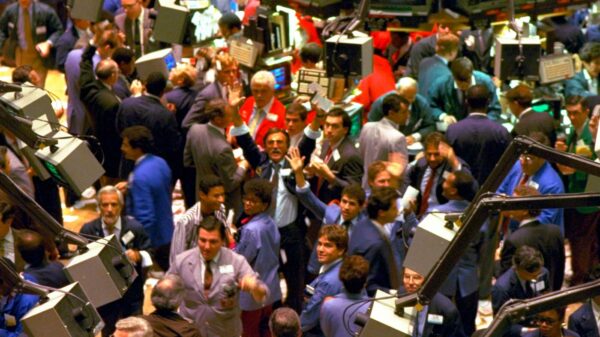

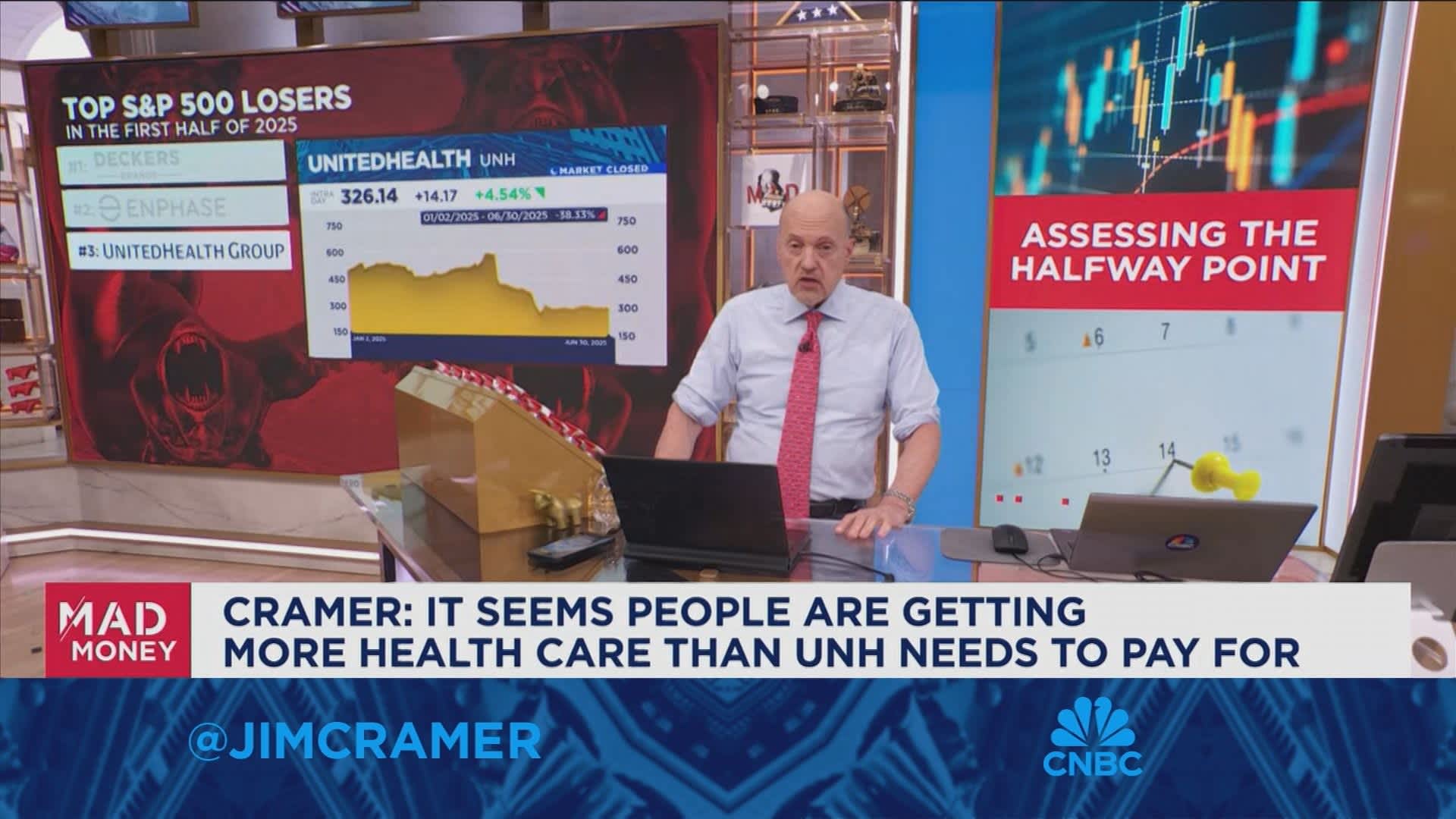

In a recent episode of CNBC’s “Mad Money,” host Jim Cramer delved into the performance of the S&P 500, highlighting the most significant underperformers during the first half of 2025. As investors navigate a volatile market landscape, Cramer’s insights offer a crucial examination of the factors driving these declines.

The S&P 500, a benchmark for U.S. equities, has experienced a turbulent start to the year. Several companies have seen their stock prices plummet, raising questions about broader economic trends and sector-specific challenges. Cramer, known for his incisive market analysis, identified key players that have struggled amid these conditions.

Key Losers in the S&P 500

Among the most notable decliners, technology and consumer discretionary sectors have been hit hard. Companies like XYZ Corp and ABC Inc have faced significant headwinds, with their stocks losing over 20% of their value since January. These losses are attributed to a combination of rising interest rates, supply chain disruptions, and shifting consumer behaviors.

According to Cramer, “Investors need to be cautious as the market recalibrates. The tech sector, once a darling of the stock market, is now grappling with a reality check as valuations adjust.”

Sector-Specific Challenges

The technology sector, which has enjoyed a prolonged period of growth, is now encountering hurdles as interest rates rise. Higher borrowing costs have put pressure on tech companies that rely heavily on debt financing for expansion and innovation. Additionally, regulatory scrutiny has increased, particularly for major players in the industry.

Meanwhile, the consumer discretionary sector is contending with changes in consumer spending patterns. As inflation impacts purchasing power, consumers are prioritizing essential goods over luxury items, affecting companies that cater to non-essential markets.

Historical Context and Comparisons

This downturn in the S&P 500 recalls similar market corrections in the past. For instance, the dot-com bubble of the early 2000s saw tech stocks suffer massive losses as overvalued companies faced market realities. Similarly, the financial crisis of 2008 led to widespread declines across various sectors.

Historically, such corrections have served as a reset, allowing markets to stabilize and eventually recover. However, the current economic environment presents unique challenges, including geopolitical tensions and the ongoing impact of the COVID-19 pandemic.

Expert Opinions and Market Outlook

Experts suggest that while the current situation is challenging, it also presents opportunities for strategic investments. Financial analyst Jane Doe notes, “Periods of volatility often lead to attractive entry points for long-term investors. It’s crucial to focus on fundamentals and look for companies with strong balance sheets.”

Moreover, analysts emphasize the importance of diversification to mitigate risks. By spreading investments across various sectors and asset classes, investors can better navigate the uncertainties of the market.

Implications for Investors

The analysis of the S&P 500’s performance in early 2025 underscores the need for vigilance and adaptability among investors. As the market continues to evolve, staying informed and responsive to changing conditions will be key to managing portfolios effectively.

Looking ahead, the Federal Reserve’s monetary policy, global economic developments, and corporate earnings reports will play pivotal roles in shaping market dynamics. Investors are advised to keep a close watch on these factors as they make investment decisions.

In conclusion, while the first half of 2025 has been challenging for the S&P 500, history shows that markets have the resilience to recover. By understanding the underlying causes of current trends and maintaining a strategic approach, investors can position themselves for future success.