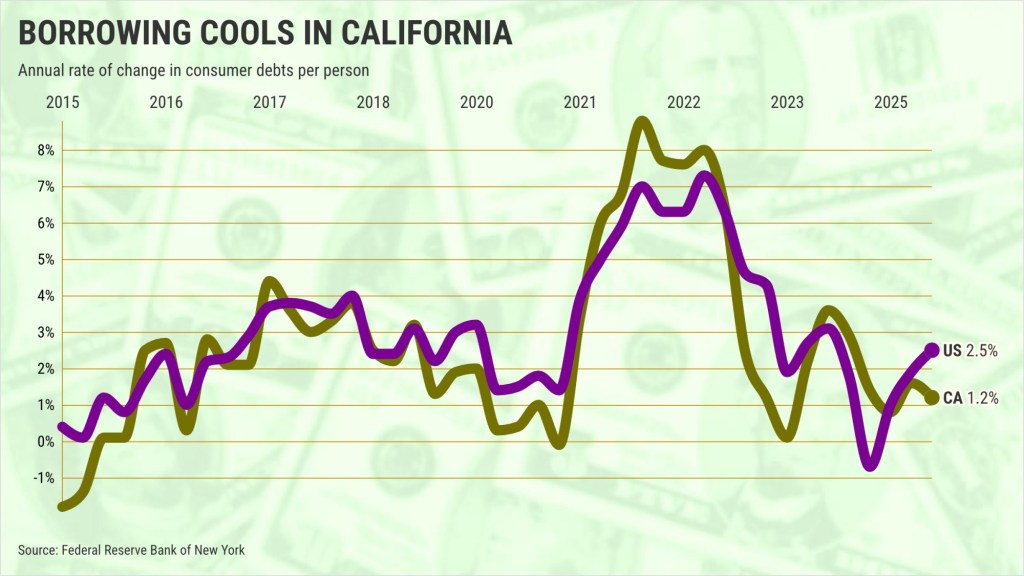

Californians have significantly reduced their borrowing activity, while simultaneously experiencing a rise in late bill payments. This trend highlights the growing financial stress among consumers in the state. Recent data from the Federal Reserve Bank of New York indicates that, in the third quarter of 2025, the average consumer debt per person in California reached $87,570, reflecting a modest 1.2% increase from the previous year. This growth is a notable slowdown from the 2.9% increase recorded in the prior year and falls short of the long-term average of approximately 3% annual growth observed since 2003.

This decline in borrowing is often associated with heightened consumer anxiety, as reflected in the Conference Board’s California consumer confidence index, which has dropped by 18% over the past year. As financial worries mount, consumers tend to limit their borrowing, indicating a cautious approach to spending.

In contrast, borrowing patterns across the United States show a different story. Nationally, consumer debt rose by 2.5% to an average of $63,340 per person, a significant increase from the 1.8% growth in the previous year. The average annual increase in consumer debt across the country remains higher at 3.2% since 2003.

Comparative Debt Trends in Major States

Examining California’s economic competitors, Texas and Florida report faster growth rates in consumer debt. In Texas, average debt per person reached $60,100, reflecting a 4.1% increase over the past year, while Florida’s average debt of $62,460 represented a 3.5% rise during the same period.

The increase in late payments is another concerning trend. In the third quarter of 2025, 2.01% of California consumer bills were at least 90 days overdue. This figure marks an increase from 1.9% and represents the highest level of late payments since the onset of the pandemic in early 2020. Despite this rise, California’s delinquency rate remains below the 3.56% average observed over the past 23 years.

On a national scale, the delinquency rate stood at 2.98% in the same quarter, which is approximately one-third higher than California’s rate. Though it reflects a slight decrease from 3.02% in the previous quarter, it still indicates a troubling trend, particularly as the national rate has averaged 3.74% since 2003. Texas and Florida reported even higher delinquency rates, at 3.85% and 4.1%, respectively.

Impact of Student Loan Repayments

A significant factor contributing to financial strain is the increasing number of missed student loan payments following the end of federal repayment pauses. Nationwide, 14.3% of student debts went unpaid in the third quarter, a sharp rise from just 0.8% a year earlier, marking the highest level of unpaid student loans since data collection began in 2000.

While the Federal Reserve did not provide state-level delinquency rates, California’s average student debt stands at $4,710 per person, representing just 5% of total borrowings in the state. This figure is notably lower than the national average of $5,540, which accounts for 9% of all borrowings. Comparatively, Texas reports an average student debt of $5,350 and Florida at $5,110, both constituting around 8% to 9% of total debts.

As the economic landscape continues to evolve, the patterns of borrowing and payment behavior in California may serve as a barometer for broader trends across the United States. Jonathan Lansner, a business columnist for the Southern California News Group, emphasizes the need for consumers to navigate these challenging financial circumstances with caution.