UPDATE: The battle over Elon Musk’s proposed $1 trillion pay package for Tesla just escalated as Norway’s sovereign wealth fund, Norges Bank Investment Management, voted against it on Tuesday. This decision comes just two days before Tesla’s crucial annual shareholder meeting scheduled for Thursday.

The fund, which manages an impressive $2 trillion and holds a 1.2% stake in Tesla, expressed serious concerns regarding the size of Musk’s compensation plan. They highlighted issues such as potential dilution and the lack of safeguards against Musk’s “key person risk”—a reference to the reliance on Musk’s leadership for the company’s future.

While acknowledging the “significant value” Musk has generated for Tesla, the fund’s decision marks a critical moment in the ongoing scrutiny of executive compensation, particularly as investors gear up for a vote on this controversial package.

This isn’t the first time Norges Bank has opposed Musk’s pay. The fund notably voted against his previous package in 2024, indicating a consistent stance on the matter. In a leaked exchange from January, Musk even described his relationship with Norges CEO Nicolai Tangen as strained, stating that “friends are as friends do.”

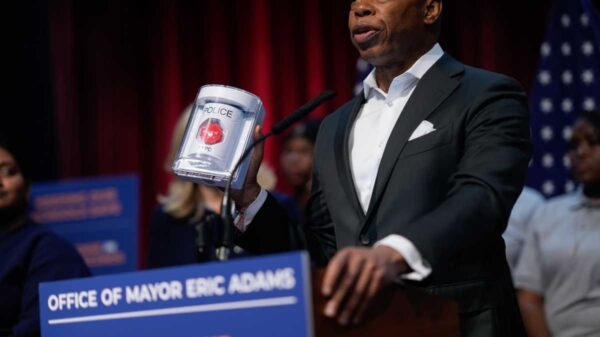

As the largest institutional investor to reveal its voting intentions on this pay package, Norges Bank’s decision could sway other investors. Significant opposition has already surfaced, with the California Public Employees Retirement System (CalPERS) and the New York State Retirement Fund joining the call against the plan. Proxy advisory firms Glass Lewis and ISS have also urged shareholders to vote no, prompting Musk to respond harshly, labeling them “corporate terrorists” during a recent earnings call.

Despite this opposition, several major investors, including Florida’s State Board of Administration and ARK Invest’s Cathie Wood, have backed Musk’s proposal. However, the two largest institutional shareholders, Vanguard and BlackRock, have yet to disclose their voting positions, adding an element of uncertainty to the upcoming decision.

The ambitious compensation plan is designed to yield Musk around $1 trillion in Tesla shares over the next decade, contingent on meeting several lofty targets. These include increasing Tesla’s market cap to $8.5 trillion, selling 1 million Optimus robots, and significantly boosting annual earnings beyond those of tech giants like Meta and Google.

Tesla has not yet responded to requests for comment regarding this developing situation. As the clock ticks down to Thursday’s vote, all eyes will be on how investors react to Musk’s pay proposal amid growing concerns over executive compensation and corporate governance.

Stay tuned for updates as this story unfolds.