URGENT UPDATE: The U.K. job market is facing a critical crisis as officials express deep concerns over unreliable economic data. This alarming situation comes just days before major staffing firm Hays provides its latest trading update, which could reveal significant insights into the employment landscape.

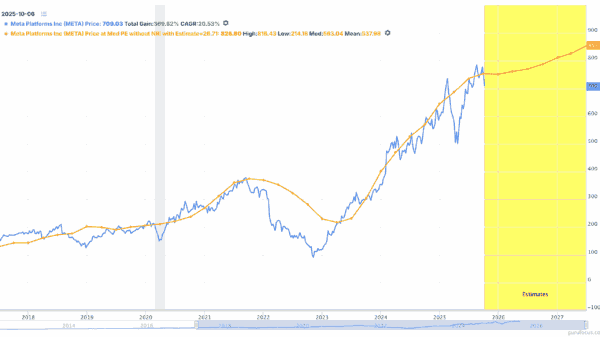

On Friday, October 20, 2023, Hays will update investors on recent trading, and analysts are eagerly anticipating clues that could illuminate the state of the U.K. job market. This follows a tumultuous period marked by serious doubts over the quality of data from the Office for National Statistics (ONS), which has delayed the release of several key economic indicators.

Recent revelations indicate that the ONS has been struggling with a significant drop in responses for its Labour Force Survey (LFS), a critical tool used to calculate the U.K.’s unemployment rate. The survey’s reliability is further undermined by complaints from members of the Bank of England’s Monetary Policy Committee, including Governor Andrew Bailey, who labeled the data quality as a “substantial problem.”

The ONS previously suspended the LFS publication in October 2023, citing a collapse in response rates due to the pandemic, with internal communications revealing a shockingly low sample size of just five individuals for some data points. This inadequacy raises serious questions about the accuracy of the reported unemployment rate, currently at 1.69 million claimants in August.

Concerns extend beyond just unemployment figures, as the U.K. faces unprecedented levels of economic inactivity, with a staggering 21.1% of working-age individuals classified as inactive. Health-related issues are the primary driver, with reports indicating that 90% of those on sickness benefits remain on them for two years or longer. This has led to fears that the U.K. could be on track to spend £100 billion annually on these benefits by the end of the decade.

Despite these troubling statistics, the job market still shows signs of resilience, with an estimated 728,000 vacancies remaining unfilled. This paradox highlights a critical skills shortage across various sectors, which is pushing average earnings, excluding bonuses, up by 4.8%. This increase is causing discomfort within the Bank of England as they grapple with inflationary pressures.

As Hays prepares to release its update, investors and policymakers alike are keenly observing how these trends will influence the broader economic climate. The staffing sector has become increasingly vital in interpreting the ongoing labor market dynamics, especially as AI technology disrupts traditional employment patterns and the U.K. tightens its visa regime.

The implications of these developments extend beyond numbers; they affect real lives. With many workers grappling with health issues that keep them from the labor market, the potential for a significant waste of talent looms large. This crisis in the U.K. job market serves as a stark reminder of the urgent need for effective policies that address both immediate employment challenges and long-term structural issues.

As the situation continues to evolve, all eyes will be on Hays and its industry counterparts for insights that could shape the future of the U.K. economy. The urgency for clarity in this complex landscape has never been more pronounced.

Stay tuned for further updates as this story develops, and remember to share this information with those who need to stay informed about the state of the U.K. job market.