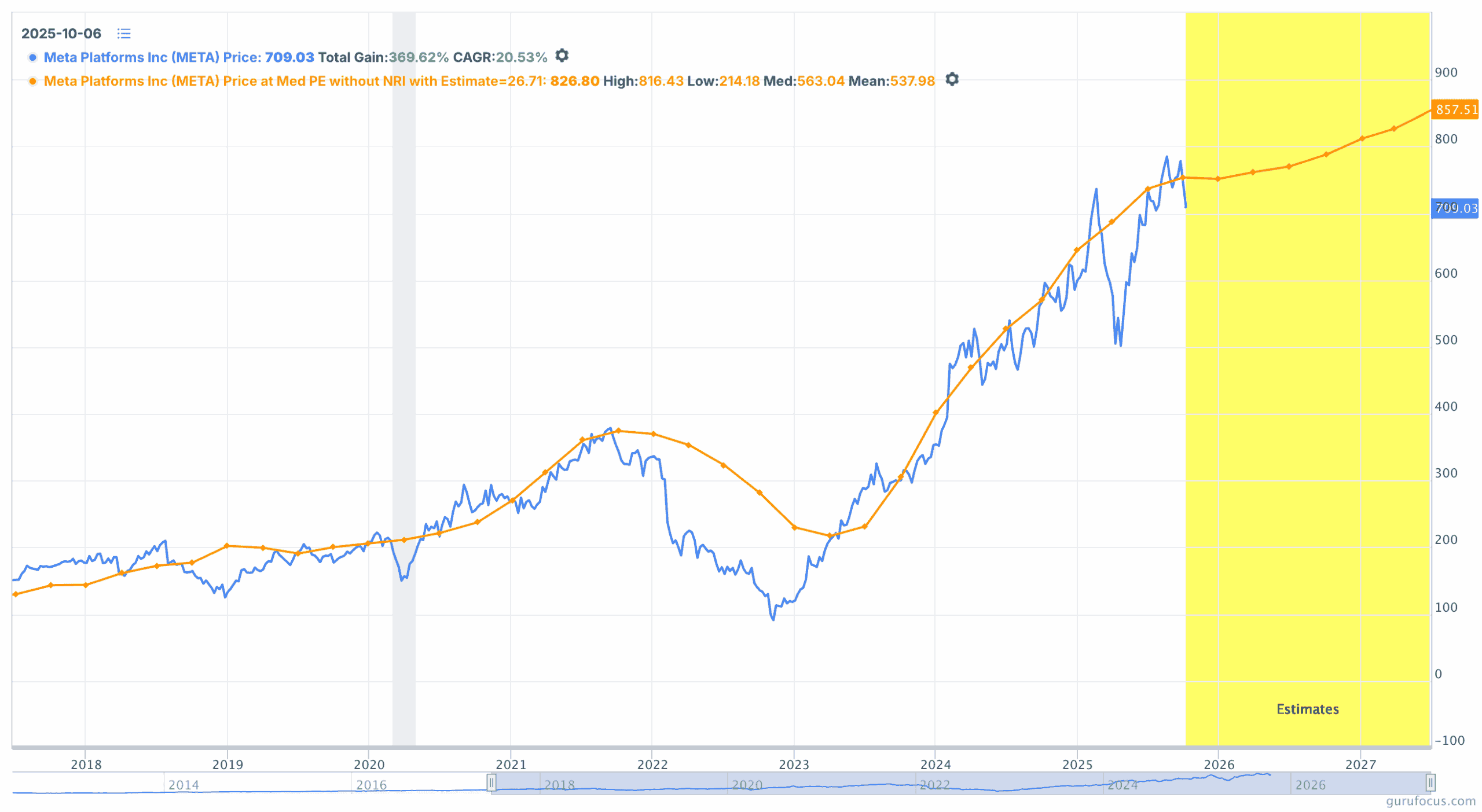

Meta Platforms Inc. (NASDAQ:META) has experienced a remarkable resurgence, largely fueled by a renewed focus on artificial intelligence. Following a steep decline in 2022, when META stock fell by as much as 76% from its peak, the company has shifted its strategy. Mark Zuckerberg redirected investments from the struggling Reality Labs segment, where the ambitious metaverse project had become a significant financial burden, towards AI initiatives that have rejuvenated growth.

The turning point for META stock came in November 2022, coinciding with the release of ChatGPT. This technological advancement marked the beginning of a recovery, resulting in a staggering increase of over 680% from a low of $90. Strong financial results have played a crucial role in sustaining this momentum.

Strong Financial Performance Drives Investor Confidence

Meta’s Q2 2025 earnings release on July 30 showcased impressive results. The company reported revenues of $47.5 billion, a 22% increase year-over-year, surpassing analysts’ expectations by $2.8 billion. Key metrics indicated growth across the board, including an 11% rise in ad impressions and a 9% increase in average ad prices. Even the Reality Labs segment narrowed its losses to $4.5 billion, suggesting a potential turning point for this once-dominant area.

Looking ahead, management has guided Q3 revenue expectations between $47.5 billion and $50.5 billion, indicating a midpoint that suggests 20% growth year-over-year. Analysts predict earnings per share (EPS) of around $6.62, with some projecting figures closer to $7 based on robust advertising checks and a weaker dollar. This optimistic outlook hints that guidance may again prove conservative, providing potential for further stock price increases.

AI Initiatives and Strategic Partnerships Set the Stage for Growth

The narrative surrounding Meta has shifted significantly from concerns about user retention to excitement about the company’s AI capabilities. A recent partnership with CoreWeave, valued at $14.2 billion, is expected to enhance Meta’s AI infrastructure significantly. This collaboration is anticipated to bolster the company’s advertising revenue, as AI-driven tools become increasingly integral to its offerings.

Currently, META stock trades at approximately 25.7 times earnings. When adjusted for net cash, this multiple rounds to 25 times, which is relatively low for a technology firm anticipated to grow its revenue by around 16% annually in the coming years. Additionally, EPS is projected to grow by 11.6% as a direct result of AI investments.

Despite potential uncertainties, the outlook remains positive. Unless there is a significant negative shift in guidance during the October 29 earnings call, the upward momentum from the recent quarter is expected to carry through the holiday period, paving the way for additional gains in 2026. Analysts have set an average price target of $853, indicating a potential upside of 20.2% from current levels, with the highest target reaching $1.1k if AI initiatives continue to enhance financial performance.

With these factors in mind, the consensus among analysts is leaning towards buying META stock. A solid Q3 performance could reignite the rally, making it an attractive investment opportunity for those looking to capitalize on the company’s promising trajectory.