Lunos Inc., a financial technology startup, officially launched today with $5 million in funding aimed at transforming the accounts receivable process through artificial intelligence. The company, founded in 2024, seeks to address what it identifies as a significant inefficiency in the payment practices of businesses, particularly in the business-to-business sector.

The core issue Lunos AI aims to tackle is the disparity between consumer and business payment practices. While consumers pay upfront for goods, businesses typically settle transactions after services or products have been delivered. According to Lunos AI, this system still relies heavily on manual processes involving finance teams, who manage an overwhelming volume of emails and paperwork.

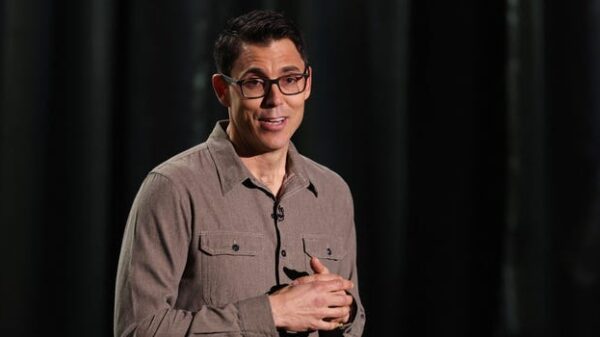

“This isn’t a payments problem; it’s a communication and negotiation problem,” emphasized Duncan Barrigan, founder and Chief Executive of Lunos AI. He noted that finance teams waste countless hours chasing payments, answering questions, and reconciling accounts with incomplete information. Barrigan argues that this human-centric approach is not scalable and cannot be optimized as effectively as consumer checkout processes.

Lunos AI’s innovative platform introduces an AI worker that integrates with tools like Slack and email, as well as its web application. This AI agent connects to various data sources, including QuickBooks and NetSuite, and is designed to analyze customer interactions to determine the best course of action. It effectively manages two-way conversations regarding balances and invoices, thereby streamlining the accounts receivable process.

The vision behind Lunos AI is to create a network of AI agents that facilitate business-to-business commerce. This network would enable agents to communicate with each other on behalf of their respective businesses, resulting in faster and more efficient payments. Barrigan stated, “The trained AI agents handle cash flow and ensure businesses get paid faster.”

The funding for Lunos AI was co-led by General Catalyst Group Management and Cherry Ventures Management GmbH. Angel investors, including current and former chief financial officers and executives from notable companies such as Eli Lilly and Co., Trustly Group AB, Deliveroo plc, Typeform S.L., and GoCardless Ltd., also participated in this pre-seed round.

Dinika Mahtani, a partner at Cherry Ventures, reflected on the potential impact of Lunos AI, stating, “When I worked in finance, I could only dream of a coworker that automated receivables, chased invoices, and managed the admin. With Lunos, that’s now a reality.”

As Lunos Inc. embarks on its journey to reshape the accounts receivable landscape, the financial technology sector will be watching closely to see how its AI-driven solutions evolve and enhance the efficiency of business transactions.