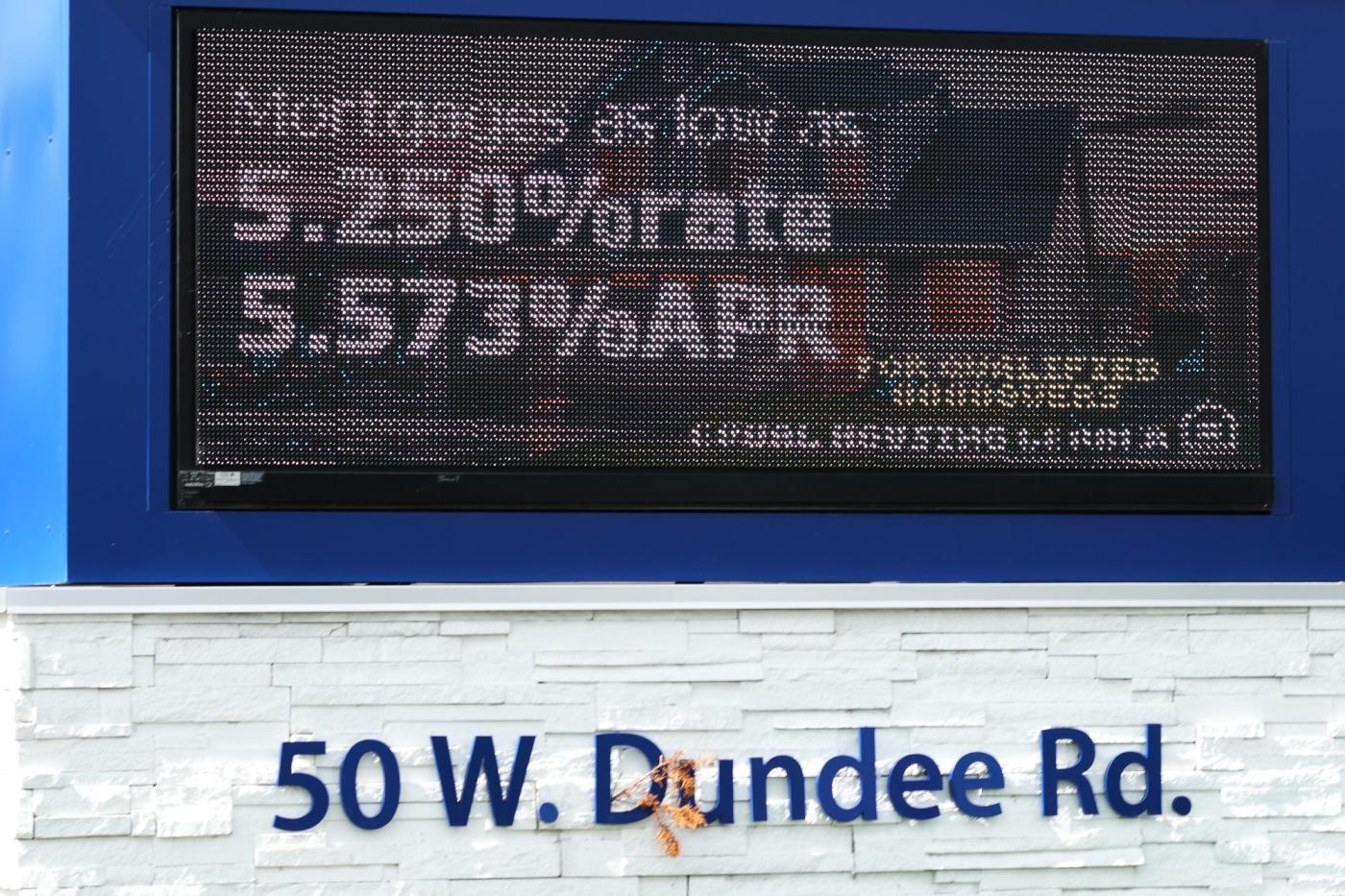

The average rate on a 30-year mortgage in the United States increased this week, concluding a four-week decline that had brought borrowing costs to their lowest levels in nearly a year. According to mortgage buyer Freddie Mac, the rate rose to 6.3%, up from 6.26% the previous week. In comparison, this time last year, the average rate stood at 6.08%.

In addition to the 30-year mortgage rate, the average rate for 15-year fixed-rate mortgages, which are often favored by homeowners seeking to refinance, also saw a rise. This rate increased to 5.49% from 5.41% last week, while a year ago, it averaged 5.16%.

Factors Behind the Increase

Mortgage rates are shaped by various factors, including the monetary policy decisions made by the U.S. Federal Reserve and the expectations set by bond market investors regarding the economy and inflation. Typically, these rates align with the movement of the 10-year Treasury yield, a benchmark used by lenders to price home loans. As of midday trading on Thursday, the yield was at 4.19%, an increase from 4.16% late the day before.

The decline in mortgage rates that began in late July followed the Federal Reserve’s widely anticipated decision last week to cut its main interest rate for the first time in a year. This shift was prompted by growing concerns over the U.S. job market, which has faced challenges in recent months.

The recent decrease in mortgage costs had provided a glimmer of hope for potential homebuyers who have been constrained by elevated financing expenses. The upward trend this week may introduce new challenges for those looking to enter the housing market.

Market Impact and Future Outlook

Despite the current increase in mortgage rates, the overall trend over the past month has been beneficial for buyers. The dip in rates allowed some prospective homeowners to reconsider their options, which may lead to a gradual recovery in home sales.

While the latest rise in rates could dampen some enthusiasm, many analysts remain optimistic about the long-term outlook for homebuying as the market adjusts to the new financial landscape. Factors such as economic growth, employment stability, and consumer confidence will play critical roles in shaping the housing market in the coming months.

The ongoing fluctuations in mortgage rates will be closely watched as they continue to impact both buyers and the broader housing market.